Friday, December 31, 2010

Thursday, December 30, 2010

US Manufacturing Bright Spot

CNBC reports today:

While the situation in Japan is by far less bright, but fits well into picture of concerns expressed by ECRI yesterday, as explained in the comment by Nomura this morning:

However, the US manufacturing appears to be the brightest spot?

Click on chart to enlarge, courtesy of BNP Paribas.

HSBC's China Purchasing Mangers' Index fell to a three month-low of 54.4 in December from 55.3 in November, suggesting that the pace of business expansion in the factories of the world's second-largest economy was moderating but still strong.

While the situation in Japan is by far less bright, but fits well into picture of concerns expressed by ECRI yesterday, as explained in the comment by Nomura this morning:

In December, the Japanese manufacturing purchasing managers' index PMI rose 1.0pt m-m, to 48.3. Although the index was below the 50 watershed between economic expansion and contraction, we see it as indicating an increased likelihood that manufacturing production activity has bottomed. The new orders index rose 1.9pt m-m to 45.7, boosting the overall index. Given that the export order index continued to decline, by 0.3pt to 46.6, domestic new orders appear to have improved sharply in December. The employment index rose 0.8pt m-m to 49.5pt, in tandem with the improvement in production activity. We project that exports will see renewed recovery and acceleration from 2011 Q1 supported by economic recovery overseas, but we think downside risks need watching given the decline in the export order index.

However, the US manufacturing appears to be the brightest spot?

Click on chart to enlarge, courtesy of BNP Paribas.

Wednesday, December 29, 2010

Stimulus Hangover In Asia-Pacific

Nothing else, but stimulus hangover ... as ECRI Sees Major Economies on Verge of Recession.

Ward About To Suggest Eurozone Core Slowdown, Peripheral Recession

Simon Ward, the chief economist at Henderson Global Investors, has a cautious take on Eurozone M1 weakness suggesting core slowdown, peripheral recession.

Cannot notice that in equities today ...

Cannot notice that in equities today ...

Tuesday, December 28, 2010

Germany's Apparent Prosperity

Doesn't slip away from my sick brain the sentence written by Steve Randy Waldman:

Germany, like China, is less prosperous than it seems, because its surplus production is geared to sale for claims that cannot credibly be redeemed for what the country’s citizens would want should they exercise their option to consume.

Monday, December 27, 2010

Valuations Still Matter?

While sometimes (in fact, in the last decade or so - most of time) it looks like valuations do not matter, however, James Montier's latest note "In Defense of the "Old Always"" tells you among other things, available free of registration also here, using the words of Benjamin Graham:

"... But if my cliché is sound – and a cliché’s only excuse, I suppose, is that it is sound – then the stock market will continue to be essentially what it always was in the past – a place where a big bull market is inevitably followed by a big bear market. In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of experience, I think the present level of the stock market is an extremely dangerous one."

Thursday, December 23, 2010

European Hope?

There is so much hope for German consumer. BNP Paribas has got not only charts to tell the story today, click on charts to enlarge, courtesy of BNP Paribas.

Wednesday, December 22, 2010

Operating Versus As Reported EPS

I don't care about levels, but I am interested in the difference ...

Click on chart to enlarge, courtesy of BNP Paribas.

Click on chart to enlarge, courtesy of BNP Paribas.

Monday, December 20, 2010

Vikings Already Arriving In Destination

I cannot stop my addiction to charts, and today is devoted to views of technical analysts from Swedish SEB. Probably, the reason is as simple as it gets - charts are telling quite a lot, still the question remains the one of efficient markets.

Click on charts to enlarge, courtesy of SEB.

Click on charts to enlarge, courtesy of SEB.

Friday, December 17, 2010

Chart Of The Day: European "Hexensabbat"

I have been focusing on the European "bastard child" for some time now, but the team of technical analysts at Commerzbank went even further today, to name it "Hexensabbat", that has also another meaning: "Hexensabbat", what the English speaking folks will recognize as "witching".

Click on chart to enlarge, courtesy of Commerzbank.

So, don't get lost in volatility ...

Click on chart to enlarge, courtesy of Commerzbank.

So, don't get lost in volatility ...

Thursday, December 16, 2010

Obsessed With Sustained Growth Story?

So much talk now about sustained growth going forward ... the almighty America will run about 8% fiscal deficit of GDP to make that happen.

Click on chart to enlarge, courtesy of Nomura.

A small subsidy to private sector? So much about sustained ...

Wednesday, December 15, 2010

Lonely Bear Voice ...

Reading Kass: Color Me More Bearish

Tuesday, December 14, 2010

Merrill's Global Fund Managers "Inflate-on" ...

This month, in comparison to last month, the key message from BofA Merrill Lynch Global Fund Manager Survey are as follows:

Pro-growth, pro-riskIs it not difficult to be contrarian in such a market?

Our panel of 302 institutional investors remain optimistic on growth and risk assets. But monetary policy stimulus is clearly pushing investors into inflation-plays such as resource stocks in December and away from bonds. The downside risk to consensus is a Q1 dip in Chinese growth; the upside risk is a broadening out in bank-boosting growth upgrades across the G7.

Growth bulls with nagging China doubts

The tone of December’s survey remains pro-growth. A net 44% see stronger global growth (was 15% in Oct) and a net 51% expect corporate profits to improve (was 11% in Oct). Growth optimism is also revealed by more investors saying they want companies to increase capex rather than return cash to shareholders. The fly in the ointment is China growth with a net 12% now seeing weaker growth, a sharp reversal from 16% expecting stronger growth last month.

The Fed has raised inflation expectations

Expectations for ongoing monetary stimulus (6 out of 10 see no Fed hike until 2012) have caused inflation expectations to surge. A net 61% forecast higher inflation, close to a 6-year high. Thus far this is not impacting risk appetite: average cash balances increased only marginally to a still-low 3.6%, hedge funds remained engaged with gearing rising to 1.48x (highest since March-08). Asset allocators increased their bond U/W to 46%, the most pessimistic since April.

US bulls: $ and equities

Investors are the most bullish on the US in 6 months with equity allocation rising to a net 16% OW (from 1%), overhauling Eurozone which fell to 4% UW from 15% OW last month. EM is the consensus long at 50% OW but Japan saw a sharp rise to 13% UW (from -29%) and is now seen as the most U/V region. Investors are USD bulls with a net 36% expecting 12m appreciation (vs. 14% last month).

Material moves as Energy replaces tech as most popular

Sector moves were pro-cyclical, pro inflation and pro-resources with materials reaching its highest OW(+28%) since 2003 and energy now the most popular global sector (36% OW) deposing technology for the first time in 12 months. Greater cyclical exposure was funded by cutting telecoms, utilities and financials.

On the contrary

The trading sell signal triggered by low cash holdings worked briefly last month before being swept up by positive US macro data. Handicapping the risks of US growth, EM inflation and EU peripheral funding against pro-cyclical positioning could see a need for portfolio rebalancing into next year. For contrarians the sells are: EM equities, energy and technology; buys: global financials, utilities, Europe.

Monday, December 13, 2010

London Banker About Sovereign Defaults & Bank Capital

He is back, and tells the story ...

The key message, from my perspective I was reminding last week:

The key message, from my perspective I was reminding last week:

If any OECD state were to default there would be very serious implications:

- The Basle Accord zero risk weight of government debt in Basle Accord calculations would be proved fanciful;

- The assumption of government debt as a liquid asset suitable for bank Tier 1 reserves to meet unanticipated and sudden cash demands will become unsustainable;

- Banks would be forced to recapitalise at much higher levels, forcing even sharper deleveraging and contraction of lending;

- Governments would lose the captive, uncritical investor base they have relied on to finance excess public expenditure for the past 30 years;

- Central banks could be forced to suddenly monetise even more government debt if required to meet the cash demands of a run on their undercapitalised banks.

It will likely prove impossible to reform the bankers and central bankers dependent on the Basle Accords for their business models and careers.

Friday, December 10, 2010

Growth Recesssion?

Could you ever imagine something like that? People at Hoisington just do that ...

Thursday, December 09, 2010

Improved And Sustained Growth Outlook With Broken Credit Channels?

The economists at Goldman Sachs are reminding us about how broken the credit channels remain (via banks/financial sector), despite improved (?) growth outlook, and little has changed in the last 6 months or so ...

Click on chart to enlarge, courtesy of Goldman Sachs.

Fool me all the time ...

Click on chart to enlarge, courtesy of Goldman Sachs.

Fool me all the time ...

Wednesday, December 08, 2010

Chart Of The Month ...

... from Tobias Levkovich, the US equity strategist at Citigroup Global Markets. Click on chart to enlarge, courtesy of Citigroup Global Markets.

And this comment is a good reminder on fallacy of averages:

And this comment is a good reminder on fallacy of averages:

While the relationship is clouded by discussions surrounding home prices and persistent unemployment, the divergences in income, wealth distribution and spending explains much of the disconnect. Since the top 20% of American income earners disproportionately account for nearly half of all discretionary consumer spending and they own roughly 90% of all equities, the stock market’s “wealth effect” is deterministic for the capacity to spend. With the S&P 500 up 19% from its June lows, high-end consumers are likely to buy gifts for friends and loved ones.So, asset based thinking that substitutes real savings with asset price appreciation? Is there a downside to this approach?

Tuesday, December 07, 2010

US Political Gridlock Means Second Round Of Fiscal Stimulus

I expressed some concern yesterday, but, of course, I do not have an Inside Job:

... kind of soft corruption: you get paid a lot of money by the financial industry, you get put on boards, but only if you don’t rock the boat too much. Besides, you hang out with these people, and get assimilated by the financial Borg.Now, we have got Tax Cut Ironies in form of A Second Stimulus. I suppose it is a time of challenge for bond vigilantes.

Monday, December 06, 2010

US Tax Cuts Do Not Matter?

While the US consumer spending is on sustainable path to suck the government's finger, failure to prolong tax cuts so far has no impact on stock markets ...

Sunday, December 05, 2010

Decision(s)...

Developing ...

... Are not made by, and therefore the outcomes are not determined, by arithmetic averages.

... Are not made by, and therefore the outcomes are not determined, by arithmetic averages.

Friday, December 03, 2010

Chart Of The Week: About To Squeeze German Dream?

While weak US job data promises more quantitative ease, the rising input costs are about to squeeze the German dream? Click on chart to enlarge, courtesy of Commerzbank.

Thursday, December 02, 2010

Predictions From Japanese Candlestick Masters

Trichet was not very vocal about bazooka, but showed it to financial markets prostitutes. That should be enough time spent for a shy boy. Let's look at predictions from serious Japanese candle-stick masters. The way to prosperity is clear and assured?

Click on chart to enlarge, courtesy of Nomura.

Click on chart to enlarge, courtesy of Nomura.

Wednesday, December 01, 2010

Bidding For Real Trichet's Bazooka

Financial markets prostitutes, after the regular end-of-month medical surveillance, are bidding for real Trichet's bazooka today. The disease requires drastic action, and the ECB support may prove "Critical" ... see you tomorrow.

Tuesday, November 30, 2010

UBS Key Investment Themes For 2011

From global equity strategy team at UBS as of yesterday:

Click on chart to enlarge, courtesy of UBS.

- Maturing Cycle: A more mature cycle comes with consequences. For the corporate sector this means peaking profit margins and slowing earnings growth. However, we look for PE multiple re-rating to more than offset slower growth expectations.Still time to get prepared for?

- Corporate re-leveraging: The corporate sector is ripe for a multi-year period of re-leveraging. With high cash balances and peaking profit margins, RoE (return on equity) will be pressured. An increase in leverage – first as a drop in cash (via hiring and capex, buybacks, dividends, and M&A) and ultimately via debt issuance – will support RoE.

- Financials - Differentiating good and great: The difference between just a good year for returns versus a great year will come down to the Financial sector, which continues to lag the broader market. Concerns about sovereign issues and capitalization need to fade, allowing investors to look to 2012 for sustainably higher profitability to boost valuations and drive material price upside.

- Political economy: Politically-driven policy decisions will continue to impact markets in the coming year. A rise in social tension within advanced economies, sovereign debt crisis in Europe, and a rise in trade protectionism related to rebalancing of global demand are all issues that are likely to remain on markets’ radar screens.

- Dividend yields: We believe the search for yield will be an enduring theme. In the near-term, yields will be more important in more structurally weak sectors or in one-off cases where there are substantial payouts to shareholders as a part of re-leveraging.

Click on chart to enlarge, courtesy of UBS.

7 Key Calls For 2011 By SocGen

Global Asset Allocation team at Societe Generale makes following 7 Key Calls for Multi Asset Portfolio in 2011:

>> Key Call 1 – Buy EM Bonds without currency hedging vs USD or EUR in order to get exposure to EM FX. Growth profile, strong public balance sheet and the quest for yield should continue to support net inflows.While this is quarterly update, 8 months ago the calls were like these ...

>> Key Call 2 – Long Nikkei / Short HSCEI (Hang Seng China Enterprise Index): Asian inflation would be welcome in Japan, but would trigger policy tightening in China.

>> Key Call 3 – Long Corporate Bonds BBB / Short Corporate Bonds AAA: The lower-rated categories are set to outperform the higher-rated ones as the spread compression process slowly continues in H1 and investors keep looking for yield instruments.

>> Key Call 4 –Steepening of 30Y-5Y US yield curve as the Fed's QE2 programs will concentrate on 5Y maturities and are likely to feed long-term inflation threats.

>> Key Call 5 – Long Global Telecom Services / Short either Global Capital Goods or Global Utilities: prefer the high dividend yielder (Telecoms) over either the low dividend yielder (Capital Goods) or expensive and riskier assets (Utilities).

>> Key Call 6 –Buy 10Y Australian government bonds (in AUD): strengthening currency, AAA-rated offering a 5.5% yield in an environment where the market is starving for yield.

>> Key Call 7 – Keep long exposure to Gold: in order to hedge against the debasement of G4 currencies and rising long-term inflation threats.

Monday, November 29, 2010

US To Decouple from Europe?

US equities recover again from early sell-off in the morning due to concerns about European debt crisis, and multi-national corporate sector with healthy balance sheets appear to be like safe haven ...

But Jim Reid, the strategist at Deutsche Bank commented today:

But Jim Reid, the strategist at Deutsche Bank commented today:

For 2010 we're not surprised we've seen the need to rescue Greece and now Ireland. We're certainly not at all surprised to see concerns over Spain now rising again. What we're probably surprised at is given the extent of the Sovereign problems how well risk assets have performed. Had someone told us in December 2009 that Greece, Ireland, Portugal and Spain CDS would be trading +706bp, +444bp, +411bp and +210bp wider in 2010 at 988bp, 604bp, 502bp, and 323bp respectively as we near the last month of the year then we would have been very impressed that the S&P 500 and Stoxx 600 were +6.6% and +5.0% respectively YTD. For this, authorities deserve credit for containing what we still think have been and are still colossal problems. Can they succeed again next year?

Another View For Economies & Financial Markets In 2011 & Beyond

As advertised on Barron's, but more in details here, Citi came with their own view for 2011 and beyond, with brief summary outlined below:

2011 is likely to be another year of strong but uneven global growth. We forecast global GDP growth of about 3.4% in 2011 and 3.8% in 2012 — somewhat below the 2010 pace (3.9%) — but still above the 1999-08 average of 2.9% YoY. The expansion will remain very uneven, more so than in prior recoveries. EM Asia should again outperform as the multi-decade transformational booms in China and India continue, not just in 2011 but for many years after. Industrial countries overall should record only modest growth in 2011 because of private sector deleveraging and, in many cases, fiscal consolidation. Divergences are likely to remain acute in the euro area, with continued above-trend growth in Germany but — even after severe recessions — little or no growth in the periphery countries. Global imbalances should stay high.

The Fed, ECB and BoJ are all likely to keep policy rates on hold in 2011. We have delayed our forecast for the first ECB hike into 2012. The Fed probably will keep rates on hold until well into 2012, with the BoJ on hold until at least late 2013. Only a few industrial countries are likely to hike rates in 2011: those with high growth (e.g. Australia, Sweden, Switzerland) and — amidst sticky inflation — perhaps the UK. By contrast, with strong growth and rising inflation pressures, tightening should be widespread across EM in Asia and LatAm. We expect China to hike by a further 125bp by end-2011 and more thereafter.

Chief Economist Essay by Willem Buiter ... There is no absolutely safe sovereign — ‘rates analysis’ has to be done together with ‘credit analysis’. Ireland’s bailout package will buy some time, but does not address its fundamental solvency issues. The Irish case also highlights the need for an EA/EU wide bank resolution regime. Portugal is likely to access the EFSF soon, in our view.

Citi’s market strategists have generally looked for reasonable returns from risk assets over the last year and remain reasonably constructive for the coming year — albeit emphasizing the need to be selective amidst uneven global growth.

Thursday, November 25, 2010

Bailouts "Über Alles" Today

Axel Weber was vocal already yesterday. The economists at Commerzbank, in addition to comment at Bloomberg, wrote:

But today's headlines from DowJonesNewswires provided another boost for equities again, should read bottom-up for historical appearance:Germany’s most important central banker, the head of the Bundesbank Axel Weber, therefore made it clear yesterday that if necessary the EFSF funds would be increased and speculation against the euro was therefore pointless. To the surprise of many in the audience he pointed out in a speech in Paris that we were no dealing with a crisis of the euro and the Eurozone but the problems of individual countries. So what are we to make of his comments? (1) Weber’s monetaristic view that we were dealing with a crisis of individual countries rather than of the Eurozone is correct. But from the instance when the Eurogroup decided to help Greece and then extended the rescue package to all other countries it became a crisis of the Eurozone. (2) The reference that if necessary the EFSF funds would simply be increased is intended to illustrate to the markets: we will stick to our plans and we know what to do. The announcement is however quite dangerous. After all it is far from certain whether the funds can be increased as easily as that. The German chancellor for example would have to face the Bundestag once again asking for further funds. There is likely to be increased resistance in other donor countries too. So there is a danger that markets are going to consider also this statement to be premature thus increasing market scepticism regarding the ability to act among those responsible. (3) So that leaves Weber’s assurances that an attack on the euro was pointless. The fact alone that there are transactions worth USD 1000bn. in EUR-USD every day illustrates that there cannot be any speculation. What we are experiencing at present is not a speculative attack but a (justified) depreciation due to unsolved problems. Moreover levels above 1.30 in EUR-USD demonstrate that the euro is still not a weak currency.

*DJ ECB Weber: Fiscal Policy, Not Euro Itself, Is Source Of Current ProblemsClick on intra-day chart of German DAX Equity Index to enlarge, courtesy of Bloomberg.to enlarge, courtesy of Bloomberg.

*DJ ECB Weber: Crisis Has Damaged Euro-Zone's Function As Stabilizer

*DJ ECB Weber: Future Mechanism Won't Impact Existing Contracts

*DJ ECB Weber: Swift Decisions On Mechanism Would Calm Markets

*DJ ECB Weber: Need Well-Prepared Crisis Mechanism

*DJ ECB Weber: Need Broad Early Warning System Going Forward

*DJ ECB Weber: Euro-Zone Sanction Proposals Not Automatic Enough

DJ ECB Weber: Euro-Zone Members Have No Choice But To Protect Euro

*DJ ECB Weber: EUR140B More In Aid Would Be Supplied If Necessary

*DJ ECB Weber: Spain Highly Unlikely To Need Euro-Zone Aid

*DJ ECB Weber: Scenarios Where Existing Bailout Too Small Almost Impossible

*DJ ECB Weber: Existing Euro-Zone Bailout Only Too Small In Most Pessimistic Scenarios

*DJ ECB Weber: Euro Is Not In Danger

*DJ ECB Weber: No Functional Alternative To Euro

*DJ ECB Weber: Euro Among World's Most Stable Currencies

While the Spanish 10-year government bonds remained little impressed, click on intra-day chart, courtesy of Bloomberg.

Wednesday, November 24, 2010

Commodities Tradewinds?

It is quite clear that equities in material and energy sectors have outperformed the commodities itself. Click on the charts below to enlarge, courtesy of Goldman Sachs.

But, the interesting thing around this situation is the opinion of analysts at Goldman Sachs:

But, the interesting thing around this situation is the opinion of analysts at Goldman Sachs:

Instead, it seems as if China worries have been heaped on the formerly “rich” asset class – commodities – not the “cheap” one – equities. Now, the state of affairs is quite the opposite, with equities rich on these measures and commodities cheap. And unlike during the 2008 episode, we think the usual convergence dynamics will likely hold sway, with the current gap once again closing.Did you know that commodities were "rich"?

Tuesday, November 23, 2010

Pyongyang Draws Attention

Asian markets tumbled today, as Pyongyang draws attention again. Nomura had to say as follows:

The real drama, though, is and will be played in Europe, in my opinion. The Gods of Finance should save the Italy, but Spain is clearly on the path to challenge the credit ... as the cash benchmark yield spreads to Germany reveal today, see the chart below.

Historically, Pyongyang has resorted to this kind of tactic to draw international attention and restart talks. It is likely that today’s attack was also motivated by the desire to initiate discussions again. Although we expect significant international pressure to keep the North/South situation calm, which should allow markets to return to some normality, with only relatively vague details available at this juncture (e.g uncertainty over the full number of casualties; the extent of multilateral sanctions) it is difficult to judge whether this will be a prolonged event for markets.However, strong hands make bold decisions? Danske opines that status quo no longer an option.

The real drama, though, is and will be played in Europe, in my opinion. The Gods of Finance should save the Italy, but Spain is clearly on the path to challenge the credit ... as the cash benchmark yield spreads to Germany reveal today, see the chart below.

Monday, November 22, 2010

Bailing Out Irish Uncompetitiveness

Of course, exposure to Irish wealth bubble makes markets nervous, and the bailout news are crowding out the headlines also today. Just to sense how far the Irish are from German bottom look at the chart below.

Click on chart to enlarge, courtesy of Deutsche Bank.

Just wait when and if Spain comes to the forefront.

Click on chart to enlarge, courtesy of Deutsche Bank.

Just wait when and if Spain comes to the forefront.

Friday, November 19, 2010

Tug Of War - Latest Global Outlook By BNP Paribas

While you can read all main features here, the risks are:

On growth, recent data suggest that downside risks have diminished considerably, led by China. The chances of a double dip in the US have reduced by about half from the previous 25%. The Fed’s QE also reduces downside risks.

Overall, growth risks are balanced. The upside risk is firms eventually putting cash balances to work in investment and hiring. The downside risk is no improvement in labour markets or consumer incomes and spending.

Vulnerability remains to financial shocks, though the less severe reaction to stress in the eurozone peripherals suggests a reduced sensitivity.

Data may be uneven due to slow final demand growth and inventory and trade swings. The market’s assessment of growth could be fickle.

Europe’s periphery remains a problem and opinions may swing due to data, political developments in the periphery and German comments driven by domestic politics. Adverse shocks are more likely than good ones, which would be EUR negative. Bad news about banks cannot be ruled out either.

We are confident about subdued core inflation in the eurozone, US and Japan. China’s inflation could continue to surprise on the upside but price controls should reduce risks on this front. The main upside risks we worry about are food and oil, in that order. Headline inflation remains subject to difficult-to-predict swings.

On policy, the Fed could surprise on QE – but in our view more likely by doing more rather than less than has already been announced. The skew of risks on ECB policy is probably towards more tightness. Wage developments as well as growth in Germany will be important to ECB policy. China could be more aggressive on tightening than we think if inflation is stronger, giving downside risks to risk assets.

Tensions remain severe between the US and China and more clashes seem likely on the currency, risking currency and trade wars.

We expect markets to be volatile, but central banks will try to curb the vol. They might even succeed, in which case risk assets would do better and the USD might be weaker.

The market’s reaction to QE2 remains uncertain over the longer term. On the one hand, the Fed is reducing Treasury supply to the market, which is bond positive, while promising to raise inflation – which is bond negative.

The bond forecasts look balanced near term, but upside risks from commodity risks give an upside skew later.

QE2 is a downside risk for the USD across the board.

BBVA Goes On China Banking Watch

Success in capital-raising contains risks, according to BBVA today.

Thursday, November 18, 2010

Markets Have Taken "Spanish Fly" For Purposes Of Seduction

Irish bailout talks appear like a dose of "Spanish Fly" for the markets today. While the growth in Spain stalls, the pressure in the ticking time bomb in Europe climbs higher today. 5-year benchmark cash yield of Spanish government bonds reached the year-to-date closing high today in nominal terms, while the spread to Germany was observed a bit higher just a week ago ...

Click on charts to enlarge, data courtesy of Thomson Reuters.

Click on charts to enlarge, data courtesy of Thomson Reuters.

Wednesday, November 17, 2010

Fat Tails Of Nominal US Returns In Low Interest Rate Environment

This is from cross asset analysts at SEB in relation to US investment returns for an optimal 15% VaR portfolio "benchmark" for period of 1915-2010 :

While we have had good returns recently, is it time for fat tails now?

High returns and fat tails on both sides when rates are “low”. The benchmark portfolio has had a real return of 4.2% when interest rates have been in the “low” range, higher than the two other regimes, but not as impressive as in the 12-month inflation analysis. The risk effect is the same, though: fat tails on both sides push the risk up. In the “low” interest rate environment, the historical VaR was 23.7%, clearly above the full sample’s 16%. The nominal return of 6.8% is below the full sample average, and the risk increase is even sharper with nominal historical VaR close to twice as high as full sample and CVaR above 40%. As with 12-month inflation, the “low” regime has both the biggest gains and the biggest losses.Click on charts to enlarge, courtesy of SEB.

While we have had good returns recently, is it time for fat tails now?

Tuesday, November 16, 2010

Merrill's Global Fund Manager Sentiment At Its Most Bullish Since April 2010

Key takeaways from the BofA Merrill Lynch Global Fund Manager Survey this month:

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

What risks?

The most bullish sentiment since April

The November FMS shows market sentiment at its most bullish since April 2010. Put simply QE2 has raised both global growth & inflation expectations, reduced cash balances to dangerously low levels and caused capitulation into risk & inflation assets. The bullish consensus makes a normal year-end rally very vulnerable to a deflationary rally in the US$. Progress in the EU sovereign funding concerns and/or strong economic data that boosts bank stocks are now needed to prolong the Autumn risk rally.

Loose policy...surging growth and inflation expectations

The net percentage forecasting stronger global growth jumped from 15% to 35%, while inflation expectations surged from 27% to 48%. The perception that monetary policy is "too easy" rose to its highest level (45%) since July 2004. There was an intriguing decline in Chinese growth expectations while the biggest consensus "tail risk" is a European sovereign debt default.

Risk on: feel the quantity, not the quality

Asset allocators have drained cash reserves (a rare U/W reading of 5%) with average cash holdings falling to just 3.5%; this triggers a contrarian tactical sell signal for equities. Our risk appetite index rose to 45 (the highest since April) and with less than 1 in 5 investors believing a Fed rate hike is likely before Q4 next year, investors raised equities up to net 41% O/W from 27% in Oct and cut bonds to a net 36% U/W (from -24%).

Maximum Bullish on EM & Materials

The proportion of allocators O/W EM increased to a net 56%, close to an all time high. Despite sovereign debt concerns, rotated into Eurozone equities, and the 15% O/W is the largest since 2004. Japan remains the most unloved equity region. In sectors, Tech and Energy remain the favoured global sectors but investors rotated aggressively into Materials (9% to 21%) and out of consumer, pharma and industrials. Banks remain the largest U/W among global investors.

For the contrarians

Despite tail risk concerns in Europe, a clear risk-on message emerges from the survey; but with cash levels falling to low levels there are contrarian signals embedded in that message. At the very least we could see a balancing out of defensive vs. cyclical buying but the risk of a market correction now looks high. For contrarians the sells are commodities, EM equities, global tech and materials and the buys are cash, Japanese equities, global banks and utilities.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

What risks?

Monday, November 15, 2010

Chart Of The Day

Very seductive, but not necessary explains causality despite long time series ...

Click to enlarge, courtesy of BCA Research.

Click to enlarge, courtesy of BCA Research.

What The US Consumer Is Spending?

While media attention today is focused on better than expected retail sales figures in US, the new manufacturing orders in New York region are collapsing, but it is interesting to interpret all that US consumer spending bullishness from the perspective of income sources.

Click on chart to enlarge, courtesy of CLSA Asia-Pacific Markets.

Yes, cut that government spending finally ...

Click on chart to enlarge, courtesy of CLSA Asia-Pacific Markets.

Yes, cut that government spending finally ...

We Are In Emerging Markets Super-Cycle

FT.com/beyonbrics runs the short story told by Standard Chartered today, that the sun shines on emerging markets, and happening for a decade already ... at least according to Standard Chartered.

I have more fascinating charts here. Click on charts to enlarge, courtesy of Standard Chartered.

Somehow the emerging markets story should be supported to ride the wave ...

I have more fascinating charts here. Click on charts to enlarge, courtesy of Standard Chartered.

Somehow the emerging markets story should be supported to ride the wave ...

Friday, November 12, 2010

Nomura: The Good, The Bad And The Ugly

While Spain is my bastard child, but also an eye should be kept on berlusconian Italy. Here is an highly informative chart about banking strains from Nomura's fixed income team. Click on chart to enlarge, courtesy of Nomura.

Thursday, November 11, 2010

Global Macro Imbalances In Terms Of Current Account Balance Since 1970

Does global macro matter? There are not only benefits from flatter world and global trade that micro managers in equities try to establish as a cult ... risk premiums are definitely going down?

Click on chart to enlarge, courtesy of Swedbank.

Click on chart to enlarge, courtesy of Swedbank.

Wednesday, November 10, 2010

Reading Tragedy Of The Technocrats By Waldman

Not only to break the recent addiction to painting arts, but ... die Seele schoenen (German) ... latest contribution to our amoral world by always the must read Steve Waldman.

French Eye On American Dream

I have gone very technical recently, and the technical picture of American dream from BNP Paribas just adds to the series of painting arts today ... click on picture for more than thousand words, courtesy of BNP Paribas.

Tuesday, November 09, 2010

Standard Chartered Paints The Key Stuff

Nice charts from technical analysts at Standard Chartered yesterday. I take a look at ICE Brent Oil as the benchmark, as WTI crude is often distorted by storage fun:

And here is the view on sick Dr. Copper:

- The USD 86.00/bbl target was met, and USD 89.58/bbl should give way to USD 90.75/bblClick on chart to enlarge, courtesy of Standard Chartered.

- Dips are expected to remain limited to the USD 86.00/bbl zone now

- Technically, we expect the uptrend to extend further towards 91.85/bbl and higher

And here is the view on sick Dr. Copper:

- LME copper prices should challenge rising trendline resistance at USD 8,730/tClick on chart to enlarge, courtesy of Standard Chartered. Don't worry, the QE will take care of your wealth ...

- We favour a break higher after this to test resistance at USD 8,940/t

- Technically, we expect pullbacks to remain limited, with further gains to follow

Monday, November 08, 2010

SocGen: China Now Drives The Global Manufacturing Cycle

From the economists at Societe Generale:

Click on charts to enlarge, courtesy of Societe Generale.

... the aggregate global PMI snapped back by 1.2 ppts in October. What we have then is the US, European and global PMI's following Chinese PMI with a lag of around 2 months. This is a complete turnabout from the pre-crisis world where the Chinese PMI tended to follow the G3 PMI's with a lag of between 1-2 months. Causality has completely switched in the post-crisis world.

Click on charts to enlarge, courtesy of Societe Generale.

Ready for a surprise?

Are Cheap Forward P/E Estimates A Strong Argument?

Look at Pan-European forward consensus P/E estimates in historical perspective that speaks of itself. Indeed, so much for forward P/E argument ...

Click on chart to enlarge, courtesy of Nomura, my annotation.

Click on chart to enlarge, courtesy of Nomura, my annotation.

Friday, November 05, 2010

Virtuous Circle Of Feel Good

As prescribed by Ben, I feel good and confident, and committed to contribute my share to struggling "economies" of Porsche, LVMH, PPR, Richemont ...

Though, the confidence does not change the annual revenues from investment in equities so quickly, therefore the gains will be realized by selling ...

Though, the confidence does not change the annual revenues from investment in equities so quickly, therefore the gains will be realized by selling ...

Thursday, November 04, 2010

Equity Bull Already Talking About Career Risk & Cognitive Dissonance?

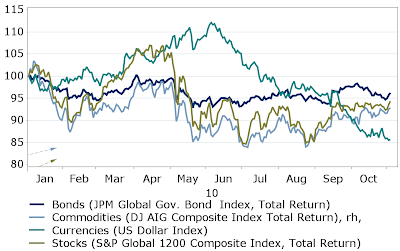

I did look at US equities in terms of EURo couple of days ago, and we may experience a bullish breakout, but so far the screaming US equity bull is deluding himself in terms of debased US dollar. I already hear the talk of career risk and cognitive dissonance. Interestingly, but bonds have been the best performing asset class for a global investor in terms of major currencies so far this year, even for USD based investor.

Click on charts to enlarge, courtesy of Jan Bylov, Nordea Markets. Asset class performance in USD.

Asset class performance in EUR.

Asset class performance in JPY. Note, that Japanese are making loss in all global asset classes, but would have been even better off by sticking with domestic zero yielding cash.

Asset class performance in terms of SDR basket.

Click on charts to enlarge, courtesy of Jan Bylov, Nordea Markets. Asset class performance in USD.

Asset class performance in EUR.

Asset class performance in JPY. Note, that Japanese are making loss in all global asset classes, but would have been even better off by sticking with domestic zero yielding cash.

Asset class performance in terms of SDR basket.

Everyone should be negative about USD?

Wednesday, November 03, 2010

The Fed Makes 4% Of Nominal GDP Ponzi-fied Easy

The Fed had to say something today, but everyone knows how many miles they are behind the curve. QE2 broadly in line with expectations of 4% nominal GDP ponzified easy.

Nice Reminders From The Chartology Experts At UBS

While we all await the announcement of QE2 monster, let' s look at some perspectives via charts prepared by technical analysts at UBS.

This seems to be the pattern markets try to follow right now, with short memories. Click on charts to enlarge, courtesy of UBS.

This is the Dow Jones decennial cycle.

This is how secular bear markets play out, but note that 70ties were structurally different via high inflation.

I stick to Japanese candle-stick masters, so far ... that assumes a correction to see how strong the bulls are. But that may change quickly.

This seems to be the pattern markets try to follow right now, with short memories. Click on charts to enlarge, courtesy of UBS.

This is the Dow Jones decennial cycle.

This is how secular bear markets play out, but note that 70ties were structurally different via high inflation.

I stick to Japanese candle-stick masters, so far ... that assumes a correction to see how strong the bulls are. But that may change quickly.

Tuesday, November 02, 2010

Look At US Equity Bull In Terms Of More Serious Currency

There is a lot of excitement in the US about the stock market performance lately. However, I decided to look at US equities in EURo terms, and not the US dollar that is supposed to be "quantitatively easyfied" again.

This is MSCI USA Standard Core Net Index in EUR, courtesy of MSCI. Click on chart to enlarge.

While a lot of bullishness just before breaking out in terms of more serious currency, the technicals are "rolling over". While true bulls may continue to advance ...

This is MSCI USA Standard Core Net Index in EUR, courtesy of MSCI. Click on chart to enlarge.

While a lot of bullishness just before breaking out in terms of more serious currency, the technicals are "rolling over". While true bulls may continue to advance ...

Growth Is Back In Baltic Depression Economies

Latest take on Baltic Rim by Nordea available here! The epicenter of turmoil has a lot still to do, according to Swedbank.

Monday, November 01, 2010

Monetary Base And Yields & S&P500 In USA 1927-1946

High Priest of Keynesian school Paul Krugman runs a story of QE In The GD today. And for hose who study also history of more than 10 years ago it is clear that US defaulted on its obligations by suspending gold standard in 1930-ties, and did Quantitative Easing.

However, equities failed to appreciate during second expansion of monetary base, while 10 year Treasury yields continued to move down in 1930ties. Take a look at charts below, prepared by SEB's x-asset team, click to enlarge.

For inquiring minds the question of "WHY?" should arise. Well, the same Paul Krugman provided the explanation using accounting identities?:

However, equities failed to appreciate during second expansion of monetary base, while 10 year Treasury yields continued to move down in 1930ties. Take a look at charts below, prepared by SEB's x-asset team, click to enlarge.

For inquiring minds the question of "WHY?" should arise. Well, the same Paul Krugman provided the explanation using accounting identities?:

The process of paying down debt, however, must obey two rules:

1. Those who pay down debt must do so by spending less than their income.

2. For the world as a whole, spending equals income.

It follows that

3. Those who are not being forced to pay down debt must spend more than their income.

But here’s the problem: there’s no good mechanism in place to induce those who can spend more to do so. Low interest rates do encourage spending; but given the size of the debt shock, even zero rates are nowhere near low enough.

So since the world economy can’t raise the bridge, it is lowering the water: without sufficient spending from those who can, the only way to make the accounting identities hold is for incomes to decline — specifically, the incomes of those not constrained by debt must decline so as to create a sufficiently large gap between their (unchanged) spending and their incomes to offset the forced saving of debtors. Of course, the mechanism here is an overall global slump, so the debtors are squeezed as well, forced into even more painful cuts.

Subscribe to:

Comments (Atom)