I did look at

US equities in terms of EURo couple of days ago, and we may experience a bullish breakout, but so far the screaming US equity bull is deluding himself in terms of debased US dollar. I already hear the talk of career risk and

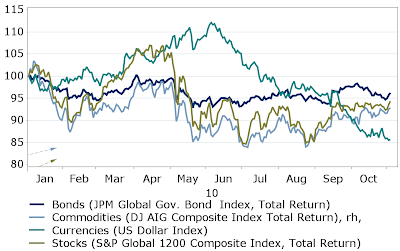

cognitive dissonance. Interestingly, but bonds have been the best performing asset class for a global investor in terms of major currencies so far this year, even for USD based investor.

Click on charts to enlarge, courtesy of Jan Bylov, Nordea Markets. Asset class performance in USD.

Asset class performance in EUR.

Asset class performance in JPY. Note, that Japanese are making loss in all global asset classes, but would have been even better off by sticking with domestic zero yielding cash.

Asset class performance in terms of SDR basket.

Everyone should be negative about USD?

great charts. thanks

ReplyDelete