- Maturing Cycle: A more mature cycle comes with consequences. For the corporate sector this means peaking profit margins and slowing earnings growth. However, we look for PE multiple re-rating to more than offset slower growth expectations.Still time to get prepared for?

- Corporate re-leveraging: The corporate sector is ripe for a multi-year period of re-leveraging. With high cash balances and peaking profit margins, RoE (return on equity) will be pressured. An increase in leverage – first as a drop in cash (via hiring and capex, buybacks, dividends, and M&A) and ultimately via debt issuance – will support RoE.

- Financials - Differentiating good and great: The difference between just a good year for returns versus a great year will come down to the Financial sector, which continues to lag the broader market. Concerns about sovereign issues and capitalization need to fade, allowing investors to look to 2012 for sustainably higher profitability to boost valuations and drive material price upside.

- Political economy: Politically-driven policy decisions will continue to impact markets in the coming year. A rise in social tension within advanced economies, sovereign debt crisis in Europe, and a rise in trade protectionism related to rebalancing of global demand are all issues that are likely to remain on markets’ radar screens.

- Dividend yields: We believe the search for yield will be an enduring theme. In the near-term, yields will be more important in more structurally weak sectors or in one-off cases where there are substantial payouts to shareholders as a part of re-leveraging.

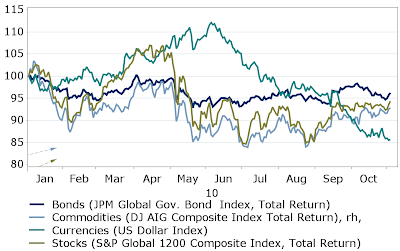

Click on chart to enlarge, courtesy of UBS.