All of a sudden, investors seem to be spotting bright green shoots. A bounce in January’s economic data, both West and East (China mainly), has got commentators salivating in anticipation that the bottom of the economic cycle might be close. Hey, even UK house prices managed to bounce almost 2% mom – the first decent monthly rise in over a year. Maybe, against all the odds, Lazarus is about to take up his bed and walk?

One lesson from Japan’s lost decade is that, despite remorseless deflationary headwinds, the occasional aggressive policy response did produce some quite decent cyclical recoveries. Hence some very healthy cyclical equity market rallies can be enjoyed within the long Ice Age structural bear market.

That is exactly what the western equity markets enjoyed from 2003-2008. At the time, they felt like the real thing and investors fell in love with the rally. Instead they need to become far more promiscuous in their willingness to chop and change their equity preferences as the cycle ebbs and flows. Lack of attachment is a vital quality in The Ice Age.

We believe the US equity market is, even now, only “fair” value on our longer term cyclically adjusted PE measures - by contrast Europe could be considered cheap. We expect the lack of market cheapness in the US will result in a further 40% slide in equity prices as depression-like economic and profits data continue through 2009.

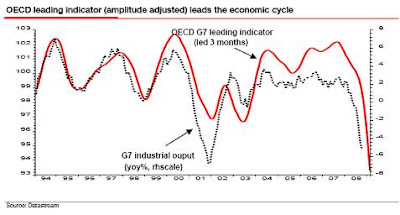

Our clear view is that we would expect depression-like data to continue to overwhelm investors for the foreseeable future. If the global economic cycle is hitting bottom I will eat my and any other hat clients produce. Nevertheless we are watching the leading indicators closely (see chart below), for even a moderation of the rate of economic deterioration may spark a bear market rally as investors mistake it for the prelude to actual recovery. Similarly, after the initial October 1929 crash, hopes of economic stabilisation sparked a 50% rally in early 1930. When this proved a false dawn equities fell a further 80% before hitting bottom!

FT Alphaville has more to say here ...

FT Alphaville has more to say here ...

No comments:

Post a Comment