I am back, but I cannot promise the posting will be regular going forward.

My "focus list" consisting of Spanish and Italian bonds, and JPY worked well, however all of those instruments have experienced interventions by central banks and cannot be considered as leading indicators anymore.

The liquidity crisis usually resolves with a victim, and while none of fundamental macro problems have been solved, the liquidity will just postpone the resolution.

However, for the greedy people we all are, I would be still cautious beyond the obvious speculative action. Danske Bank had a good reminder yesterday, see the picture below, but you decide whether the witch-hunt has ended.

Click on picture to enlarge, courtesy of Danske Bank Markets.

Wednesday, August 24, 2011

Tuesday, July 05, 2011

Moody's Does Not Like Portugal

As the European government debt crisis just seemed to turn the corner, Moody's junked the Portugal today...

Monday, July 04, 2011

Credit Agricole: Sisyphus Cannot Simply Kick The Can Down The Road

Posting will be very light, or even absent in July. For the longer reading the latest macro prospects by Credit Agricole are at your disposal here.

Thursday, June 30, 2011

Second Anniversary Of Impossible Equation

With the second round of "Greek bail-outs" already passed the "feel good" kicking of the can down the road goes on. However, I return to history that has second anniversary today, when I singled out the report by Societe Generale and posted on this blog SocGen: Public Finances - The Impossible Equation two years ago. The first anniversary I remembered with Anniversary Of Impossible Equation. But how far have we got today?

As Keynes noted:

"In the long run we are all dead."

Anyway?

As Keynes noted:

"In the long run we are all dead."

Anyway?

Wednesday, June 29, 2011

Liquidity Glut And Low Interest Rates

I have been writing about liquidity glut and low interest rates, and their impact on real economy some time ago. Gerard Minack, the strategist at Morgan Stanley, brings up this issue today and makes it very clear, again:

Exhibit 1 shows the contribution to the 12 month return on US equities from the change in the prospective PE ratio (the PE based on consensus earning forecasts). The amplitude is significant: the swing in the PE often contributed plus or minus 20-30 percentage points to the annual equity return. Importantly, the biggest influence on the PE ratio was interest rates. Falling rates led to a rising PE, and vice versa. (The line in the chart is the 12 month change in the 10 year Treasury yield – but it is inverted: so the line goes up as yields go down.)

Click on chart to enlarge, courtesy of Morgan Stanley.

Well, the times may be changing, as Gerard Minack continues:

This was the basis for the ‘don’t fight the Fed’ mantra. In a credit super cycle – when investors are willing to increase borrowing as rates fall – lower rates are good for risk assets.

A post-bubble environment is different. As I’ve discussed before, macro cycles tend to be weaker and more fragile. As importantly, investors do not respond to lower rates in the same way as they did through the credit super-cycle.

On a days like today it feels like bubble never ended? Some evidence of global stabilisation?

Exhibit 1 shows the contribution to the 12 month return on US equities from the change in the prospective PE ratio (the PE based on consensus earning forecasts). The amplitude is significant: the swing in the PE often contributed plus or minus 20-30 percentage points to the annual equity return. Importantly, the biggest influence on the PE ratio was interest rates. Falling rates led to a rising PE, and vice versa. (The line in the chart is the 12 month change in the 10 year Treasury yield – but it is inverted: so the line goes up as yields go down.)

Click on chart to enlarge, courtesy of Morgan Stanley.

Well, the times may be changing, as Gerard Minack continues:

This was the basis for the ‘don’t fight the Fed’ mantra. In a credit super cycle – when investors are willing to increase borrowing as rates fall – lower rates are good for risk assets.

A post-bubble environment is different. As I’ve discussed before, macro cycles tend to be weaker and more fragile. As importantly, investors do not respond to lower rates in the same way as they did through the credit super-cycle.

On a days like today it feels like bubble never ended? Some evidence of global stabilisation?

Tuesday, June 28, 2011

China's Local Government Financing

On a day when markets seek for a Greek relief rally, as the Greek default may appear like mission impossible and the real challenge for Greeks now to get into such mess, I am looking at "perceived hope" of growth in China, while the financing of that growth becomes more riskier. The economists at Societe Generale are offering their views on China's local government financing issues today. I skip here the consensus optimism, but look at potential problems, as per economists at Societe Generale:

...China’s local government debt problem is scary in different ways. A simple calculation based on the information available in the report suggests that the total debt load increased 36 times in nominal terms and fivefold relative to GDP between 1997 and 2010! More than 80% of the money has gone to finance hard infrastructure. Economically speaking, an increasingly bigger share of total capital has been allocated to the public sector, and the marginal return of each borrowed yuan has been on a steady decline. In the last three years, total liabilities of local governments nearly doubled in size and ballooned from 17% to 27% of GDP. The health of China’s public debt and investments is deteriorating at its fastest pace ever.

Click on charts to enlarge, courtesy of Societe Generale.

Now, if one assumes that investments are "hard infrastructure" and often (about one quarter) of "debt is promised with land sales revenues", the maturity profile may provide some challenges as loans are maturing.

But then again, quoting the economists at Societe Generale:

... we can say China is different as there is no clear trigger of a sudden emergence of bad debt. Both debtors and creditors belong to the government, more or less.

...China’s local government debt problem is scary in different ways. A simple calculation based on the information available in the report suggests that the total debt load increased 36 times in nominal terms and fivefold relative to GDP between 1997 and 2010! More than 80% of the money has gone to finance hard infrastructure. Economically speaking, an increasingly bigger share of total capital has been allocated to the public sector, and the marginal return of each borrowed yuan has been on a steady decline. In the last three years, total liabilities of local governments nearly doubled in size and ballooned from 17% to 27% of GDP. The health of China’s public debt and investments is deteriorating at its fastest pace ever.

Click on charts to enlarge, courtesy of Societe Generale.

Now, if one assumes that investments are "hard infrastructure" and often (about one quarter) of "debt is promised with land sales revenues", the maturity profile may provide some challenges as loans are maturing.

But then again, quoting the economists at Societe Generale:

... we can say China is different as there is no clear trigger of a sudden emergence of bad debt. Both debtors and creditors belong to the government, more or less.

Monday, June 27, 2011

Italian Job

Nothing really new here for Italian long-term story, but simply worth adding to my "Focus List" consisting of Spanish Government bonds and JPY so far. Just because we are testing key technical levels here, and the overall story gets more compelling with Italian banks running hot media headlines.

Click on chart to enlarge, courtesy of Reuters.

Summer to be interesting with the peripheral yield games in spotlight?

Click on chart to enlarge, courtesy of Reuters.

Summer to be interesting with the peripheral yield games in spotlight?

Thursday, June 23, 2011

80 JPY In Focus Too

Another "inflection point" on my screens is the mark of 80 Japanese yens (JPY) per 1 US dollar. This is rather important for Japan in watching the Chinese slowdown.

"... Preliminary China June PMI Falls to 11-Month Low", as per WSJ.com today:

The preliminary HSBC PMI declined from a final reading of 51.6 in May, while the manufacturing output sub-index fell to an 11-month low of 50 from the previous month's 50.9, HSBC Holdings PLC said Thursday.

Of course, the soft landing in China is consensus view, but the tight liquidity situation may bring some "fat tails". However, the 80 JPY mark will show where the market goes ...

Click on chart to enlarge, courtesy of Reuters.

"... Preliminary China June PMI Falls to 11-Month Low", as per WSJ.com today:

The preliminary HSBC PMI declined from a final reading of 51.6 in May, while the manufacturing output sub-index fell to an 11-month low of 50 from the previous month's 50.9, HSBC Holdings PLC said Thursday.

Of course, the soft landing in China is consensus view, but the tight liquidity situation may bring some "fat tails". However, the 80 JPY mark will show where the market goes ...

Click on chart to enlarge, courtesy of Reuters.

Wednesday, June 22, 2011

Spanish Government Bonds In Focus

As the interest rate strategists at Commerzbank write today, despite hope for better sentiment in the weeks ahead:

At the same time, the risks of a re-widening in spreads from lower levels later this year have increased. Should politicians fail to come up with a coherent plan to ring-fence Greece in the case of default, highly adverse consequences like a bank run in Greece or Spanish yields moving to unsustainable levels cannot be ruled out.

Click on chart to enlarge, courtesy of Commerzbank.

Interestingly, but 10-year Spanish government bonds appear to be testing unchartered waters with a potential upside breakout from technical perspective, while still below the point of no return at 6%, as per Commerzbank. At the same time 5-year Spanish bonds still appear somewhat friendly...

However, this is one area to keep an eye on.

At the same time, the risks of a re-widening in spreads from lower levels later this year have increased. Should politicians fail to come up with a coherent plan to ring-fence Greece in the case of default, highly adverse consequences like a bank run in Greece or Spanish yields moving to unsustainable levels cannot be ruled out.

Click on chart to enlarge, courtesy of Commerzbank.

Interestingly, but 10-year Spanish government bonds appear to be testing unchartered waters with a potential upside breakout from technical perspective, while still below the point of no return at 6%, as per Commerzbank. At the same time 5-year Spanish bonds still appear somewhat friendly...

However, this is one area to keep an eye on.

Tuesday, June 21, 2011

Nomura: How Much Of A US Slowdown Is In The Price?

Interesting observations by strategists at Nomura today:

While June ISM risks are skewed to the downside, growth-related assets seem to be underestimating the possibility of a disappointing outcome. Figure 1 compares the ISM index with the year-on-year changes in our common measure of US market-implied growth, which we define as the first component of a PCA on a group of US growth-related assets. It is apparent that after months of relative pessimism the market is now trying to look through the recent data and view it as a transitory slowdown. As such, growth assets appear vulnerable to further disappointing data in June. Currently, on this simplistic measure the market implies an ISM of roughly 57.0 vs our economists forecast of 51.8 and the Philly Fed's dismal ISM-equivalent reading of 45.5.

While buying Treasuries and selling stocks would be the natural trade to position for a deeper-than-expected ISM dip, optimising this trade could be key given current valuations. Figure 2 looks at the relative mispricing of each asset with respect to the common US growth component. Clearly, while Treasuries would benefit from a disappointing growth outcome, yields already appear too low compared with the rest of the assets in our universe and arguably offer only a limited reward. Conversely, S&P Consumer services, oil and copper still appear too optimistic with respect to growth, despite their recent retrenchment, and thus offer an interesting trade for investors positioning for a longer and deeper "soft patch" than currently expected.

Click on charts to enlarge, courtesy of Nomura.

Well, markets seem to be focused on "technically oversold" conditions and Greek "victory" today...

While June ISM risks are skewed to the downside, growth-related assets seem to be underestimating the possibility of a disappointing outcome. Figure 1 compares the ISM index with the year-on-year changes in our common measure of US market-implied growth, which we define as the first component of a PCA on a group of US growth-related assets. It is apparent that after months of relative pessimism the market is now trying to look through the recent data and view it as a transitory slowdown. As such, growth assets appear vulnerable to further disappointing data in June. Currently, on this simplistic measure the market implies an ISM of roughly 57.0 vs our economists forecast of 51.8 and the Philly Fed's dismal ISM-equivalent reading of 45.5.

While buying Treasuries and selling stocks would be the natural trade to position for a deeper-than-expected ISM dip, optimising this trade could be key given current valuations. Figure 2 looks at the relative mispricing of each asset with respect to the common US growth component. Clearly, while Treasuries would benefit from a disappointing growth outcome, yields already appear too low compared with the rest of the assets in our universe and arguably offer only a limited reward. Conversely, S&P Consumer services, oil and copper still appear too optimistic with respect to growth, despite their recent retrenchment, and thus offer an interesting trade for investors positioning for a longer and deeper "soft patch" than currently expected.

Click on charts to enlarge, courtesy of Nomura.

Well, markets seem to be focused on "technically oversold" conditions and Greek "victory" today...

Monday, June 20, 2011

Bonds Outperforming Equities

Well, this was initiated couple of months ago. Mary Ann Bartels et al. at BofA Merrill Lynch paints the bigger picture of equities versus bonds, and note today:

From a mid February high, the stocks vs. bonds ratio has corrected and is testing the rising 200-day moving average.

There are not yet any firm bottoming signs for stocks relative to bonds. This suggests that stocks should continue to underperform bonds in coming days/weeks.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

Should we assume we move towards the bottom of the channel?

From a mid February high, the stocks vs. bonds ratio has corrected and is testing the rising 200-day moving average.

There are not yet any firm bottoming signs for stocks relative to bonds. This suggests that stocks should continue to underperform bonds in coming days/weeks.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

Should we assume we move towards the bottom of the channel?

Friday, June 17, 2011

Chinese "Quantitative Easing" In One Chart

From the economists at Morgan Stanley, the Chinese growth miracle explained in one chart. Though, not the full story.

Click on chart to enlarge, courtesy of Morgan Stanley.

Add the fiscal "orgy" to this...

Click on chart to enlarge, courtesy of Morgan Stanley.

Add the fiscal "orgy" to this...

Thursday, June 16, 2011

Jump In Correlations In European Credit Markets

The message from credit strategists at BNP Paribas today:

A confluence of events has increased volatility which could turn systemic in nature. With correlations bunching up once again and trending towards 1.0, the message from the markets is loud and clear that systemic risk is rising and liquidity is poor, which is being reflected in higher volatility and risk premia.

Click on chart to enlarge, courtesy of BNP Paribas.

If this is not enough, one should consider - what has made US markets "so weak" recently?

Click on chart to enlarge, courtesy of BNP Paribas.

Well, ECRI tells us not to blame Japan for slowdown ...

A confluence of events has increased volatility which could turn systemic in nature. With correlations bunching up once again and trending towards 1.0, the message from the markets is loud and clear that systemic risk is rising and liquidity is poor, which is being reflected in higher volatility and risk premia.

Click on chart to enlarge, courtesy of BNP Paribas.

If this is not enough, one should consider - what has made US markets "so weak" recently?

Click on chart to enlarge, courtesy of BNP Paribas.

Well, ECRI tells us not to blame Japan for slowdown ...

DBS Sees "Summer Lull A Window Of Opportunities" For Asia Equities

DBS came out with latest Asset Allocation report today, as for Asian equities the view is more than clear:

• The short-term ebbs and flows we are currently experiencing are nothing but a proverbial 'tempest in a tea cup'. Financial instability in Europe and an economic soft patch in the US heighten risks, but not enough to derail the ongoing global recovery

• Volatility and mixed data signals are the norm at this stage of the cycle. We find comfort in attractive valuations, supported by realistic earnings growth expectations. Asian equities as an asset class are cheap relative to cash and inflation

• Asian markets probably bottomed at the end of March and should end the year comfortably higher than current levels. The passing of QE2 is unlikely to be a big event. The associated risks are rising bond yields and capital outflow in the early part of 3Q. We believe the stage is set for a 2H rally after the removal of this overhang.

• We are maintaining our Overweight recommendation in Taiwan, Malaysia and Indonesia whilst Thailand is downgraded to Underweight. China, Hong Kong and India are still Underweight. Korea is upgraded to Neutral.

So, the window of opportunity may close soon, or be the wall to hit soon in full speed.

Stunning difference, that is very obvious in the picture below, creates views like this:

Click on chart to enlarge, courtesy of DBS.

Well, there are views that the "main determinant of its own fate" may face serious problems of rebalancing ...

• The short-term ebbs and flows we are currently experiencing are nothing but a proverbial 'tempest in a tea cup'. Financial instability in Europe and an economic soft patch in the US heighten risks, but not enough to derail the ongoing global recovery

• Volatility and mixed data signals are the norm at this stage of the cycle. We find comfort in attractive valuations, supported by realistic earnings growth expectations. Asian equities as an asset class are cheap relative to cash and inflation

• Asian markets probably bottomed at the end of March and should end the year comfortably higher than current levels. The passing of QE2 is unlikely to be a big event. The associated risks are rising bond yields and capital outflow in the early part of 3Q. We believe the stage is set for a 2H rally after the removal of this overhang.

• We are maintaining our Overweight recommendation in Taiwan, Malaysia and Indonesia whilst Thailand is downgraded to Underweight. China, Hong Kong and India are still Underweight. Korea is upgraded to Neutral.

So, the window of opportunity may close soon, or be the wall to hit soon in full speed.

Stunning difference, that is very obvious in the picture below, creates views like this:

Asian demand is the main determinant of its own fate

Click on chart to enlarge, courtesy of DBS.

Well, there are views that the "main determinant of its own fate" may face serious problems of rebalancing ...

Tuesday, June 14, 2011

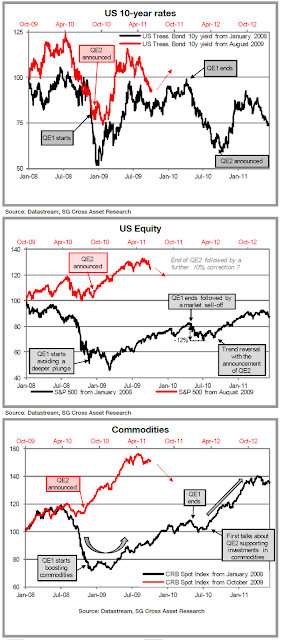

Just In Case You Thought QE2 Is Already Priced In

The strategists at Societe Generale think that QE2 is NOT priced in yet, and paint a picture of what lies ahead.

Click on charts to enlarge, courtesy of Societe Generale.

Indeed, it may be far from "worst is over" until capitulation sets in ...

Click on charts to enlarge, courtesy of Societe Generale.

Indeed, it may be far from "worst is over" until capitulation sets in ...

No Capitulation For Merrill's Fund Managers

They were about Fading Or Risking last month, this month key messages from BofA Merrill Lynch Global Fund Manager Survey are as follows:

No capitulation... no QE3

In the June FMS investors raised cash, reduced risk asset exposure and rotated to defensive sectors. But investor panic is not yet visible. The recent drop in global growth expectations stabilized and despite sharply lower inflation readings, two-thirds of investors predict no QE3.

Growth expectation stabilise

Growth and profit expectations stabilised after recent sharp falls. Inflation expectations fell to 38% from 69% two months ago. But the macro backdrop is not seen as weak enough to warrant more stimulus: three out of four panellists think a recession unlikely and only 13% expect a new round of QE in H2.

Risk is off

The percentage of investors OW cash rose to 21%, the highest since July-09. Actual cash balances rose from 3.9% to 4.2% but this did not trigger a buy signal from our trading rule. Hedge funds cut gearing levels sharply to 1.27x from 1.53x while 43% of investors believe EU sovereign debt funding is the biggest "tail risk". Overall our risk & liquidity index fell to 38, below its long term average of 40.

Gold overvaluation highest since 2009

Equity allocations fell, benefiting bonds and cash, but positioning overall stands in the middle of historic ranges. Note that the gold price is seen as more overvalued than at anytime since Dec-09 while commodity allocations again fell.

Japan remains most unloved market

Despite China growth expectations dropping to the lowest reading since Jan-09, EM remains the most preferred region for equities, pipping the US. Regional allocations show a big drop in exposure to Eurozone and UK equities but Japan remains the most unloved equity region.

Bank underweight most negative since March 2009

Contrarians note that the weighting in global banks fell to its lowest since March 2009. Consumer discretionary saw the largest monthly drop in exposure with the only positive sector moves coming from defensives. Tech remains the most popular sector followed by pharma and energy.

Contrarian trades...

Despite no contrarian "buy" signal for risk being triggered, the contrarian trades within the June FMS are: long banks, short gold; long Japanese banks, short US tech; long Eurozone, short EM; long US dollar, short Japanese yen.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

I have no intention to be contrarian this month ...

No capitulation... no QE3

In the June FMS investors raised cash, reduced risk asset exposure and rotated to defensive sectors. But investor panic is not yet visible. The recent drop in global growth expectations stabilized and despite sharply lower inflation readings, two-thirds of investors predict no QE3.

Growth expectation stabilise

Growth and profit expectations stabilised after recent sharp falls. Inflation expectations fell to 38% from 69% two months ago. But the macro backdrop is not seen as weak enough to warrant more stimulus: three out of four panellists think a recession unlikely and only 13% expect a new round of QE in H2.

Risk is off

The percentage of investors OW cash rose to 21%, the highest since July-09. Actual cash balances rose from 3.9% to 4.2% but this did not trigger a buy signal from our trading rule. Hedge funds cut gearing levels sharply to 1.27x from 1.53x while 43% of investors believe EU sovereign debt funding is the biggest "tail risk". Overall our risk & liquidity index fell to 38, below its long term average of 40.

Gold overvaluation highest since 2009

Equity allocations fell, benefiting bonds and cash, but positioning overall stands in the middle of historic ranges. Note that the gold price is seen as more overvalued than at anytime since Dec-09 while commodity allocations again fell.

Japan remains most unloved market

Despite China growth expectations dropping to the lowest reading since Jan-09, EM remains the most preferred region for equities, pipping the US. Regional allocations show a big drop in exposure to Eurozone and UK equities but Japan remains the most unloved equity region.

Bank underweight most negative since March 2009

Contrarians note that the weighting in global banks fell to its lowest since March 2009. Consumer discretionary saw the largest monthly drop in exposure with the only positive sector moves coming from defensives. Tech remains the most popular sector followed by pharma and energy.

Contrarian trades...

Despite no contrarian "buy" signal for risk being triggered, the contrarian trades within the June FMS are: long banks, short gold; long Japanese banks, short US tech; long Eurozone, short EM; long US dollar, short Japanese yen.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

I have no intention to be contrarian this month ...

Monday, June 13, 2011

Barclays On US Deflation Risks

While the equity investors like the industrialists of Weimar Republic are awaiting for the first hints of QE3 by Fed, I was a bit surprised that the risk of deflation appears like a distant probability. Here the latest take by economists at Barclays Capital:

The increase in inflation and inflation expectations has also coincided with a reduction in deflation risk. Figure 3 shows the probability of cumulative inflation over a one-year horizon using information from both TIPS and CPI options data. The figure shows that the probability of deflation over the one-year ahead horizon in August of last year was 36%. When 5y5y breakeven inflation reached its recent high in April of this year, the probability had fallen to about 3%. Currently, it stands at about 7%. In addition, Figure 4 shows that the market remains more willing to pay for protection against upside inflation risks than protection against excessive deflation risk. The figure plots the difference in premiums paid on +200bp out-of-the-money inflation caps and -200bp out-of-the-money inflation floors for different horizons. Because an inflation cap pays off when cumulative inflation exceeds the threshold specified in the contract, a positive reading is an indication that the caps are more expensive than the floors; in other words, the market sees the distribution of expected inflation as skewed in the direction of upside inflation risk. The trends from CPI options markets suggest that skew has been moving in the direction of willingness to pay for protection against upside inflation risk, whereas for much of last year, participants were willing to pay more for protection against deflation.

Altogether, we see the trends in inflation markets as consistent with Chairman Bernanke’s comments in his April press conference that the balance of risks between seeking additional progress on its dual mandate relative to further balance sheet expansion was “less attractive” than it was a year earlier. We therefore see the Fed as inclined to remain patient. If incoming data confirm the Fed’s view that the economy is turning up in the second half of the year, the FOMC will likely continue on its path towards normalizing the policy stance. However, if the recovery fails to regain momentum, the balance of risks may shift back in favor of further Fed action.

Click on charts to enlarge, courtesy of Barclays Capital.

Well, just in case ... "if the recovery fails to regain momentum". Why it should?

The increase in inflation and inflation expectations has also coincided with a reduction in deflation risk. Figure 3 shows the probability of cumulative inflation over a one-year horizon using information from both TIPS and CPI options data. The figure shows that the probability of deflation over the one-year ahead horizon in August of last year was 36%. When 5y5y breakeven inflation reached its recent high in April of this year, the probability had fallen to about 3%. Currently, it stands at about 7%. In addition, Figure 4 shows that the market remains more willing to pay for protection against upside inflation risks than protection against excessive deflation risk. The figure plots the difference in premiums paid on +200bp out-of-the-money inflation caps and -200bp out-of-the-money inflation floors for different horizons. Because an inflation cap pays off when cumulative inflation exceeds the threshold specified in the contract, a positive reading is an indication that the caps are more expensive than the floors; in other words, the market sees the distribution of expected inflation as skewed in the direction of upside inflation risk. The trends from CPI options markets suggest that skew has been moving in the direction of willingness to pay for protection against upside inflation risk, whereas for much of last year, participants were willing to pay more for protection against deflation.

Altogether, we see the trends in inflation markets as consistent with Chairman Bernanke’s comments in his April press conference that the balance of risks between seeking additional progress on its dual mandate relative to further balance sheet expansion was “less attractive” than it was a year earlier. We therefore see the Fed as inclined to remain patient. If incoming data confirm the Fed’s view that the economy is turning up in the second half of the year, the FOMC will likely continue on its path towards normalizing the policy stance. However, if the recovery fails to regain momentum, the balance of risks may shift back in favor of further Fed action.

Click on charts to enlarge, courtesy of Barclays Capital.

Well, just in case ... "if the recovery fails to regain momentum". Why it should?

Monday, June 06, 2011

On Hiatus This Week

The bulls(hitters) have it difficult to defend the technical support levels around 1295 for S&P500 today.

Click on chart to enlarge, courtesy of StockCharts.com (click on link for up-to-date version).

Sometimes bulls like cheaper prices, like March lows, for example ...

Click on chart to enlarge, courtesy of StockCharts.com (click on link for up-to-date version).

Sometimes bulls like cheaper prices, like March lows, for example ...

Friday, June 03, 2011

Corporate Profits & Margins At Record High Vs Real Wages

Well, let's put them both in confrontation - record high corporate profits and margins versus real wages. Then, this is the part of Keynes I believe in, while otherwise the problems have been created because we have departed from, sort of, "Austrian" school:

Business doesn’t invest and hire because they feel good, they invest and hire because they think someone will buy what they are making and selling.

There is a substantial downside for riches, as Keynes speak "Austrian". Debt destruction will lead to savings destruction, that will in turn require more savings and less consumption.

Business doesn’t invest and hire because they feel good, they invest and hire because they think someone will buy what they are making and selling.

There is a substantial downside for riches, as Keynes speak "Austrian". Debt destruction will lead to savings destruction, that will in turn require more savings and less consumption.

More Than 1000 Words Can Tell

The Blogosphere went on to look at US real wage growth today, e.g., comparing it to Great Depression, but has been my focus for a while already. Well, a nice picture from the team of Chris Wood at CLSA Asia-Pacific Markets yesterday.

Click on chart to enlarge, courtesy of CLSA Asia-Pacific Markets.

We need more stimulus, to drive trend consumption that was driven by debt bubble ...

Click on chart to enlarge, courtesy of CLSA Asia-Pacific Markets.

We need more stimulus, to drive trend consumption that was driven by debt bubble ...

Thursday, June 02, 2011

Chart Of The Day

While media still wonders around economic surprises, and I did it very clear a month ago, we move on to chart of the day, this time from credit strategists at BNP Paribas. No comment, brrrrr.

Click on chart to enlarge, courtesy of BNP Paribas.

Click on chart to enlarge, courtesy of BNP Paribas.

Wednesday, June 01, 2011

Chinese Holes

While the markets digest the bearish PMIs/ISM reports, with the weakness attributed to Japanese earthquake, I am looking elsewhere today. Actually, my mind is in China, again.

Today I list some of the "Holes in the bull argument" written by property analysts at Credit Suisse on Monday:

■ Credit Suisse proprietary surveys on banks, construction companies and unlisted developers showed no light at the end of the tunnel. Banks’ lending has become much more pragmatic, and the well-accepted perception of favouritism on SOEs may not be correct; many developers are delaying payments to construction companies, and taking private loans with interests beyond 20%—sector cash flow may get much worse soon.

■ ‘Rising salary’ may not solve China's housing affordability issue. Income growth targets and the proposed new income tax reform focus on low income class—the target customers for private housing may actually be worse off as a result.

■ The industry consolidation argument has neglected the impact to book value. Major listed developers only represent a fraction of China’s property market. The potential exodus of small developers could be overwhelming, and lowered land prices may force listed developers to adjust book value.

Click on chart to enlarge, courtesy of Credit Suisse.

By the way, China takes on its massive muni mess with a $463bn bailout, to start with ...

Today I list some of the "Holes in the bull argument" written by property analysts at Credit Suisse on Monday:

■ Credit Suisse proprietary surveys on banks, construction companies and unlisted developers showed no light at the end of the tunnel. Banks’ lending has become much more pragmatic, and the well-accepted perception of favouritism on SOEs may not be correct; many developers are delaying payments to construction companies, and taking private loans with interests beyond 20%—sector cash flow may get much worse soon.

■ ‘Rising salary’ may not solve China's housing affordability issue. Income growth targets and the proposed new income tax reform focus on low income class—the target customers for private housing may actually be worse off as a result.

■ The industry consolidation argument has neglected the impact to book value. Major listed developers only represent a fraction of China’s property market. The potential exodus of small developers could be overwhelming, and lowered land prices may force listed developers to adjust book value.

Click on chart to enlarge, courtesy of Credit Suisse.

By the way, China takes on its massive muni mess with a $463bn bailout, to start with ...

Tuesday, May 31, 2011

Paper Money - One Of China's Historic Innovations

I was reading a special report by Mizuho Securities Asia today, written by Alexandra Harney and titled "Can China Innovate?". I think for many investors, also those deep in the Austrian school, it will be a refreshing reminder, among other things, that "paper money" was introduced by China, at least so is it accounted for...

Click on picture to enlarge, courtesy of Mizuho, my annotation.

Click on picture to enlarge, courtesy of Mizuho, my annotation.

Monday, May 30, 2011

Chinese Imports Already Show Signs Of A Slowdown

I am entertaining myself with the chart below that comes from economists at Barclays Capital. We have had musings about the importance of Chinese growth story, also as a leading indicator for the global manufacturing cycle. Obviously, Chinese imports play here some role.

Click on chart to enlarge, courtesy of Barclays Capital.

The economists at Barclays Capital wrote on Friday:

... there are already signs of a slowdown in Chinese imports from the US and Europe.

Click on chart to enlarge, courtesy of Barclays Capital.

The economists at Barclays Capital wrote on Friday:

... there are already signs of a slowdown in Chinese imports from the US and Europe.

Thursday, May 26, 2011

BNP Paribas: US Bank Credit Has Underperformed Europe's

Indeed, interesting, brought to you by credit strategists at BNP Paribas today, my emphasis in bold and underlined:

It is interesting to note that while European bank paper (Senior and LT2) has widened on the back of sovereign concerns, US bank paper (Senior and LT2) has widened more over the last month due to housing double-dip, legal issues and relatively weaker economic environment. This US bank underperformance stresses two key points, namely that the GIP sovereign crisis is increasingly being seen as idiosyncratic and manageable while the US economic slowdown if sustained is likely to become a bigger issue in June.

Click on charts to enlarge, courtesy of BNP Paribas.

Well, let's see!

It is interesting to note that while European bank paper (Senior and LT2) has widened on the back of sovereign concerns, US bank paper (Senior and LT2) has widened more over the last month due to housing double-dip, legal issues and relatively weaker economic environment. This US bank underperformance stresses two key points, namely that the GIP sovereign crisis is increasingly being seen as idiosyncratic and manageable while the US economic slowdown if sustained is likely to become a bigger issue in June.

Click on charts to enlarge, courtesy of BNP Paribas.

Well, let's see!

Wednesday, May 25, 2011

Profit Margins Again

It just happens, as a follow-up on the post from yesterday, also the economists at BCA Research made their conclusions on the corporate profit margins yesterday. So, here some excerpts to consider:

Ultimately, the health of the corporate sector depends on the financial health of its customers. Thus, the divergence between rising profits and weak growth in real consumer incomes will have to change. Historically, the growth in real profits has been correlated closely with that of real consumer spending, and the wide gap in the current cycle represents a major aberration.

I have discussed the real consumer spending and especially the incomes that should drive that spending here earlier. So, here are the mains points about margins, according to BCA Research:

To conclude, the corporate sector has been enjoying a very favorable set of circumstances that will not persist. This does not mean that profit margins are about to plunge. Companies will remain intensely focused on cost control and boosting efficiency, and the weak dollar will continue to provide support to overseas earnings. However, it is hard to see margins moving higher from current levels in the coming year.

Margins and thus profits will face a severe challenge during the next recession. The ability to repeat this cycle’s aggressive cost cutting will be minimal, and pricing power will be under pressure. If we are going to have a mean reversion of margins, then that is when it will occur. A severe margin squeeze does not seem likely while the economy is still expanding.

All in all, not bad? Just imagine how much money has been thrown at non-existing problems. Save that challenge for next recession, while at least couple of bears were growling also today ...

Ultimately, the health of the corporate sector depends on the financial health of its customers. Thus, the divergence between rising profits and weak growth in real consumer incomes will have to change. Historically, the growth in real profits has been correlated closely with that of real consumer spending, and the wide gap in the current cycle represents a major aberration.

I have discussed the real consumer spending and especially the incomes that should drive that spending here earlier. So, here are the mains points about margins, according to BCA Research:

To conclude, the corporate sector has been enjoying a very favorable set of circumstances that will not persist. This does not mean that profit margins are about to plunge. Companies will remain intensely focused on cost control and boosting efficiency, and the weak dollar will continue to provide support to overseas earnings. However, it is hard to see margins moving higher from current levels in the coming year.

Margins and thus profits will face a severe challenge during the next recession. The ability to repeat this cycle’s aggressive cost cutting will be minimal, and pricing power will be under pressure. If we are going to have a mean reversion of margins, then that is when it will occur. A severe margin squeeze does not seem likely while the economy is still expanding.

All in all, not bad? Just imagine how much money has been thrown at non-existing problems. Save that challenge for next recession, while at least couple of bears were growling also today ...

Tuesday, May 24, 2011

Margins & Profit Shares At New All-Time Highs

Right, this is about our expectations, apparently. Gerard Minack at Morgan Stanley writes today:

The only way equities look cheap on a through-the-cycle earnings basis is if earnings are heading higher and stay higher (through the cycle). It so happens that the sell-side consensus expects this. It is forecasting 30% EPS growth over the next two years for developed world equities. This implies margins and profit shares at significant new all-time highs.

Click on chart to enlarge, courtesy of Morgan Stanley.

Well, at the end he made the conclusion as follows:

But the bigger-picture point is that equities have priced in a higher structural range for earnings. Equities may be cheap if earnings move into a new, even higher range. Otherwise, they appear expensive or very expensive.

Unusually bearish for sell-side consensus?

The only way equities look cheap on a through-the-cycle earnings basis is if earnings are heading higher and stay higher (through the cycle). It so happens that the sell-side consensus expects this. It is forecasting 30% EPS growth over the next two years for developed world equities. This implies margins and profit shares at significant new all-time highs.

Click on chart to enlarge, courtesy of Morgan Stanley.

Well, at the end he made the conclusion as follows:

But the bigger-picture point is that equities have priced in a higher structural range for earnings. Equities may be cheap if earnings move into a new, even higher range. Otherwise, they appear expensive or very expensive.

Unusually bearish for sell-side consensus?

Monday, May 23, 2011

What Is Chartalism?

While my Korean beauty has broken the neck, and overseas princes cannot get up on their legs (above 50 day moving average) too, my addiction to charts brought me to reading "The Revival of Chartalism" at Acting Man ... nothing to do with charts.

Thursday, May 19, 2011

Still Some Adjustments In Labor Legacy Costs To Expect

Charts below are self-explanatory, while housing is non-productive and legacy cost of domestic labor. I marked some countries that I believe deserve attention.

Click on charts to enlarge, courtesy of Goldman Sachs, my annotations in red and yellow.

More than couple of those "marked" countries are enjoying record high housing prices in nominal, real and relative terms now.

Click on charts to enlarge, courtesy of Goldman Sachs, my annotations in red and yellow.

More than couple of those "marked" countries are enjoying record high housing prices in nominal, real and relative terms now.

Wednesday, May 18, 2011

Japanese Candlestick Masters

Once again, it is time to look at latest masterpieces by Japanese candlestick masters. Recent track record is not that bad ...

Click on chart to enlarge, courtesy of Nomura.

Heh, they "do not expect US equities to embark on a renewed uptrend before summer" ...

Click on chart to enlarge, courtesy of Nomura.

Heh, they "do not expect US equities to embark on a renewed uptrend before summer" ...

Tuesday, May 17, 2011

European Debt Sinners

While Europeans are not the only sinners, the majority of brains with money are focused on EU sovereign debt issues. Economists at Erste Bank delivered excellent reminders today - who is who in this game?

Click on charts to enlarge, courtesy of Erste Bank.

Click on charts to enlarge, courtesy of Erste Bank.

Merrill's Fund Managers Are Fading Or Risking

We saw Reluctant Equity Bulls last month, this month key messages from BofA Merrill Lynch Global Fund Manager Survey are as follows:

The potential summer surprises

The May FMS sees investors questioning global growth (in a re-run of summer 2010) but enjoying ample liquidity that keeps risk appetite high. A stand-off has ensued with little change in allocation across asset classes but some switching within asset classes, typified by defensive rotation within equities. The summer surprises are either growth to the upside or liquidity disappointing as QE2 ends.

Growth expectations are falling

Only a net 10% of investors expect stronger global economic growth in the next 12m, down from 58% in Feb. This is easing inflation concerns, albeit marginally, with a net 61% seeing higher inflation down from 75% in March.

Risk appetite resilient

Three-quarters of the panel expect no Fed rate rise before 2012 and so risk appetite remains firm. Hedge funds are risk-on with 1.53x gearing the highest since Nov-07. Cash balances rose to 3.9% up from 3.7%, but remain low. Our risk appetite indicator eased to 43 but is well above the average of 40.

EU debt the tail risk but watch China

Growth fears see EU debt issues again ranking as the main investment risk. A slightly lower EU growth outlook (49 vs. 52) is being offset by US resilience and a rebound in Japan sentiment (74 vs. 42). A bigger concern is the deeper decline in China optimism with a net 28% seeing weaker growth compared to 15% in March.

Asset allocation: very modest change

Asset allocation saw modest rotation into bonds (48% UW from 58%) funded by lower commodities (12% OW vs. 24%) and equities (41% OW vs. 50%). GEM regains its position of most preferred region (29% OW vs. 22%) replacing US (26% OW). Consensus is UW Europe (-1%) and Japan (-17%). USD sentiment (48% undervalued) is one of the highest readings since 2002.

Sector rotation: defensive rotation

Sharp falls in energy (to 19% OW from 40%) and materials (2% UW from 17% OW) accompanied a sharp defensive rotation into staples (8% OW from 6% UW), pharma and telecoms. Banks are once again the most unpopular sector (26% UW down from 15%) with technology by far the most popular (35% OW).

How to trade the risk scenarios

If the summer sees stronger-than-expected growth: long banks, short pharma; long commodities, short bonds. If the summer sees weaker liquidity: long bonds, short equities; long US$, short EM.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

While there is still room for "feel good" short-term rally, it is more likely to see weaker liquidity over summer ...

The potential summer surprises

The May FMS sees investors questioning global growth (in a re-run of summer 2010) but enjoying ample liquidity that keeps risk appetite high. A stand-off has ensued with little change in allocation across asset classes but some switching within asset classes, typified by defensive rotation within equities. The summer surprises are either growth to the upside or liquidity disappointing as QE2 ends.

Growth expectations are falling

Only a net 10% of investors expect stronger global economic growth in the next 12m, down from 58% in Feb. This is easing inflation concerns, albeit marginally, with a net 61% seeing higher inflation down from 75% in March.

Risk appetite resilient

Three-quarters of the panel expect no Fed rate rise before 2012 and so risk appetite remains firm. Hedge funds are risk-on with 1.53x gearing the highest since Nov-07. Cash balances rose to 3.9% up from 3.7%, but remain low. Our risk appetite indicator eased to 43 but is well above the average of 40.

EU debt the tail risk but watch China

Growth fears see EU debt issues again ranking as the main investment risk. A slightly lower EU growth outlook (49 vs. 52) is being offset by US resilience and a rebound in Japan sentiment (74 vs. 42). A bigger concern is the deeper decline in China optimism with a net 28% seeing weaker growth compared to 15% in March.

Asset allocation: very modest change

Asset allocation saw modest rotation into bonds (48% UW from 58%) funded by lower commodities (12% OW vs. 24%) and equities (41% OW vs. 50%). GEM regains its position of most preferred region (29% OW vs. 22%) replacing US (26% OW). Consensus is UW Europe (-1%) and Japan (-17%). USD sentiment (48% undervalued) is one of the highest readings since 2002.

Sector rotation: defensive rotation

Sharp falls in energy (to 19% OW from 40%) and materials (2% UW from 17% OW) accompanied a sharp defensive rotation into staples (8% OW from 6% UW), pharma and telecoms. Banks are once again the most unpopular sector (26% UW down from 15%) with technology by far the most popular (35% OW).

How to trade the risk scenarios

If the summer sees stronger-than-expected growth: long banks, short pharma; long commodities, short bonds. If the summer sees weaker liquidity: long bonds, short equities; long US$, short EM.

Click on chart to enlarge, courtesy of BofA Merrill Lynch.

While there is still room for "feel good" short-term rally, it is more likely to see weaker liquidity over summer ...

Monday, May 16, 2011

Importance Of "Difficult To Measure" China's Growth

After the Blogger's black-out on Friday, I am back with old issues. There was a post back last November featuring the economists at Societe Generale on China driving the global manufacturing cycle. Now last Friday, but this time at Nomura, macro strategists have been trying to gauge the importance of China's growth:

While difficult to measure, we would argue China's growth has been one of a few core drivers of financial trends since the start of its recovery in early 2009. Figures 1 & 2 look at the performance of equities and currencies since the start of 2002. Each chart divides the world between those markets fundamentally linked to China and those not. These universes are then weighted by the size of imports to China as a percent of GDP. While it is difficult to gauge from these charts how important China's growth has been in driving the extent of the market recovery, its importance in driving relative trends should be pretty clear. In equity markets, countries fundamentally linked to China have outperformed other markets by nearly two-thirds over the course of the recovery. During the previous seven years, the performance between the two groups was practically indistinguishable. We have seen a similar trend in currencies. Since the beginning of the recovery, real effective exchange rates of countries linked to China have outperformed those of other countries substantially – although, unlike the equity performance, the FX outperformance of China-linked countries has simply gone some way in closing a valuation gap.

Click on charts to enlarge, courtesy of Nomura.

Well, at the end of day it is difficult to measure ...

While difficult to measure, we would argue China's growth has been one of a few core drivers of financial trends since the start of its recovery in early 2009. Figures 1 & 2 look at the performance of equities and currencies since the start of 2002. Each chart divides the world between those markets fundamentally linked to China and those not. These universes are then weighted by the size of imports to China as a percent of GDP. While it is difficult to gauge from these charts how important China's growth has been in driving the extent of the market recovery, its importance in driving relative trends should be pretty clear. In equity markets, countries fundamentally linked to China have outperformed other markets by nearly two-thirds over the course of the recovery. During the previous seven years, the performance between the two groups was practically indistinguishable. We have seen a similar trend in currencies. Since the beginning of the recovery, real effective exchange rates of countries linked to China have outperformed those of other countries substantially – although, unlike the equity performance, the FX outperformance of China-linked countries has simply gone some way in closing a valuation gap.

Click on charts to enlarge, courtesy of Nomura.

Well, at the end of day it is difficult to measure ...

Thursday, May 12, 2011

So Much About Inflation

Tiny bit about inflation from monthly Macro Strategy Views by Standard Chartered today:

Yet there is no room for complacency, given that the current round of inflation is driven by massive monetary easing and by extraordinarily high commodity prices due to a mix of supply and demand factors. No single monetary, fiscal or exchange policy tool is sufficient to arrest the situation. Given initial signs that inflation is peaking, it is critical that EM policy makers are not seen as wavering in their determination to fight inflation, and are viewed as having sufficient flexibility to reduce the risk of a hard landing. While we expect most EM central banks to continue tightening in the coming months, some – such as Brazil and China – could be close to the end of their current hiking cycles.

Click on charts to enlarge, courtesy of Standard Chartered.

Do you hear the sweet and enchanting music of "...sufficient flexibility to reduce the risk of a hard landing" and "could be close to the end of their current hiking cycles"?

There are those seductresses, Greek bird-women ... well, but not because of inflation.

Yet there is no room for complacency, given that the current round of inflation is driven by massive monetary easing and by extraordinarily high commodity prices due to a mix of supply and demand factors. No single monetary, fiscal or exchange policy tool is sufficient to arrest the situation. Given initial signs that inflation is peaking, it is critical that EM policy makers are not seen as wavering in their determination to fight inflation, and are viewed as having sufficient flexibility to reduce the risk of a hard landing. While we expect most EM central banks to continue tightening in the coming months, some – such as Brazil and China – could be close to the end of their current hiking cycles.

Click on charts to enlarge, courtesy of Standard Chartered.

Do you hear the sweet and enchanting music of "...sufficient flexibility to reduce the risk of a hard landing" and "could be close to the end of their current hiking cycles"?

There are those seductresses, Greek bird-women ... well, but not because of inflation.

Wednesday, May 11, 2011

Grantham Gets Serious, While We Look At Bubbles In Terms Of Bubbles?

The legendary Jeremy Grantham moves on today and says it is Time To Be Serious ...

However, as I have been serious for a while, I decided to look at industrial metals in terms of gold, that was brought to me by good folks Citigroup Global markets today.

Click on charts to enlarge, courtesy of Citigroup Global Markets.

Bubbles in terms of bubbles? Or, all we saw so far was just an adjustment in USD value? Well, we are indeed constrained by resources and capital in the real world, that are not reserves of fractional reserve banking.

However, as I have been serious for a while, I decided to look at industrial metals in terms of gold, that was brought to me by good folks Citigroup Global markets today.

Click on charts to enlarge, courtesy of Citigroup Global Markets.

Bubbles in terms of bubbles? Or, all we saw so far was just an adjustment in USD value? Well, we are indeed constrained by resources and capital in the real world, that are not reserves of fractional reserve banking.

Spanish Insolvencies

You thought that situation in Spain is stabilising? Well, the analysts at German Commerzbank write today:

According to provisional data of the national statistical office, the number of insolvencies in Spain reached a new high in the first quarter. The recovery of autumn 2010 was therefore short-lived. The property sector’s share of bankruptcies remains strikingly high: Property developers or construction companies accounted for nearly a third of all business failures. This persistent concentration shows that the consolidation of the Spanish real estate market is still not over. At the same time, house prices continued their downward trend: At the end of March the house price index had fallen by a further 4.6% yoy. Pressure on asset quality in the credit portfolios of Spanish financial institutions therefore appears likely to continue for the time being.

Click on charts to enlarge, courtesy of Commerzbank.

Right, all is contained and under control, as always ....

According to provisional data of the national statistical office, the number of insolvencies in Spain reached a new high in the first quarter. The recovery of autumn 2010 was therefore short-lived. The property sector’s share of bankruptcies remains strikingly high: Property developers or construction companies accounted for nearly a third of all business failures. This persistent concentration shows that the consolidation of the Spanish real estate market is still not over. At the same time, house prices continued their downward trend: At the end of March the house price index had fallen by a further 4.6% yoy. Pressure on asset quality in the credit portfolios of Spanish financial institutions therefore appears likely to continue for the time being.

Click on charts to enlarge, courtesy of Commerzbank.

Right, all is contained and under control, as always ....

Tuesday, May 10, 2011

Alternate View On Financial Repression

I was reading Is Financial Repression the Answer? via Mark Thoma today. This paragraph sits in my sick mind:

Ms Reinhart and Ms Sbrancia argue the world has forgotten that the widespread system of financial repression “played an instrumental role in reducing or ‘liquidating’ the massive stocks of debt accumulated during World War II”. ...

Well, I just thought - what are real negative rates we have seen so often recently, and are "enjoying" right now? Probably the negative real interest rates is the true, but not obvious, financial repression managed by central banks in order to collect the "Greenspan's brownies" for splendid growth story, but leads to unsustainable credit/debt accumulation and Minsky moments? Debt destruction in this context would not be repression, but liberation ...

Ms Reinhart and Ms Sbrancia argue the world has forgotten that the widespread system of financial repression “played an instrumental role in reducing or ‘liquidating’ the massive stocks of debt accumulated during World War II”. ...

Well, I just thought - what are real negative rates we have seen so often recently, and are "enjoying" right now? Probably the negative real interest rates is the true, but not obvious, financial repression managed by central banks in order to collect the "Greenspan's brownies" for splendid growth story, but leads to unsustainable credit/debt accumulation and Minsky moments? Debt destruction in this context would not be repression, but liberation ...

Alternate Seasonality At Citi

This should be an interesting approach. The small and mid cap strategists at Citi went so far to write yesterday:

This “Topics” note provides a historical look at summer seasonal trading patterns, but with an alternate set of data where we remove recessionary periods, including the “tech bubble” time period, as well as the outlier circumstance that contained the ’87 “crash”. We acknowledge that this approach entails a large element of subjectivity but, nevertheless, provides an interesting, and alternative, set of observations. Figure 1 shows the seasonal trading pattern for the Russell 2000 with all periods since index inception in 1979 included. Figure 2 provides the “alternate” look.

Click on charts to enlarge, courtesy of Citigroup Global Markets.

And it continues just like this:

The takeaway of this analysis is two fold. First, there is clear evidence of small cap seasonality during the summer months, when viewed back to Russell 2000 inception circa 1979. Second, when the ’81-’82, ’90-91 and ’08-’09 recessionary periods, along with the ’98-’02 “tech bubble” phase are removed from the seasonal analysis, a much more benign summer seasonal trading picture emerges.

We acknowledge the inherent difficulties in defining “mid cycle” from a traditional statistical perspective. While removing “recessionary” periods, as well as the tech bubble phase, increases risk of data manipulation, we argue that this is, nevertheless, as relevant as traditional historical analysis, where average calculations can be overly influenced by outlier periods.

So, we acknowledge, but we will do much more to talk up? Hey, but this is normal market practice, just assume, e.g., money market indices in Europe ...

This “Topics” note provides a historical look at summer seasonal trading patterns, but with an alternate set of data where we remove recessionary periods, including the “tech bubble” time period, as well as the outlier circumstance that contained the ’87 “crash”. We acknowledge that this approach entails a large element of subjectivity but, nevertheless, provides an interesting, and alternative, set of observations. Figure 1 shows the seasonal trading pattern for the Russell 2000 with all periods since index inception in 1979 included. Figure 2 provides the “alternate” look.

Click on charts to enlarge, courtesy of Citigroup Global Markets.

And it continues just like this:

The takeaway of this analysis is two fold. First, there is clear evidence of small cap seasonality during the summer months, when viewed back to Russell 2000 inception circa 1979. Second, when the ’81-’82, ’90-91 and ’08-’09 recessionary periods, along with the ’98-’02 “tech bubble” phase are removed from the seasonal analysis, a much more benign summer seasonal trading picture emerges.

We acknowledge the inherent difficulties in defining “mid cycle” from a traditional statistical perspective. While removing “recessionary” periods, as well as the tech bubble phase, increases risk of data manipulation, we argue that this is, nevertheless, as relevant as traditional historical analysis, where average calculations can be overly influenced by outlier periods.

So, we acknowledge, but we will do much more to talk up? Hey, but this is normal market practice, just assume, e.g., money market indices in Europe ...

Monday, May 09, 2011

Real Interest Rates And Credit Growth In Asia

The last days are traded in the sign of Greek-out, but for the sake of change we travel to Asia today.

This is a nice depiction of real growth drivers in Asia too. You simply arrange the God's Work with negative real rates, and credits simply fly, as economists at Deutsche Bank are writing:

Declining, and often negative, real interest rates against a backdrop of strong growth provide strong support for credit growth, which is rising in most Asian economies.

Click on chart to enlarge, courtesy of Deutsche Bank.

While I am not so sure that "strong growth provide strong support for credit growth", I would rather think the other way round. However, this seems to be more important now:

China is a key exception. Despite negative real interest rates, credit growth has slowed for most of the last 18 months after the surge in lending in support of the government’s stimulus program in early 2009. Interest rates do not play an important role in allocating or managing credit growth in China.

And once again, if you doubt the first paragraph, can you trust the second quote?

This is a nice depiction of real growth drivers in Asia too. You simply arrange the God's Work with negative real rates, and credits simply fly, as economists at Deutsche Bank are writing:

Declining, and often negative, real interest rates against a backdrop of strong growth provide strong support for credit growth, which is rising in most Asian economies.

Click on chart to enlarge, courtesy of Deutsche Bank.

While I am not so sure that "strong growth provide strong support for credit growth", I would rather think the other way round. However, this seems to be more important now:

China is a key exception. Despite negative real interest rates, credit growth has slowed for most of the last 18 months after the surge in lending in support of the government’s stimulus program in early 2009. Interest rates do not play an important role in allocating or managing credit growth in China.

And once again, if you doubt the first paragraph, can you trust the second quote?

Friday, May 06, 2011

Listening To Valuable Voice Of Jean-Marie Eveillard

Look for the MP3 link via King World News.

Thursday, May 05, 2011

Beauty Of 5 Standard Deviations In This Real World

Felix Salmon has the de-coding story today:

In a normally-distributed world, 5-standard-deviation moves never happen. In this world, however, such moves can happen even when there’s no news at all. (Reuters, for what it’s worth, blames “concerns about economic growth and monetary tightening”, which is code for “we have no idea why this is happening, or whether there even is a reason”.)

Click on chart of "first month Brent Crude Oil futures" to enlarge, courtesy of Reuters.

In a normally-distributed world, 5-standard-deviation moves never happen. In this world, however, such moves can happen even when there’s no news at all. (Reuters, for what it’s worth, blames “concerns about economic growth and monetary tightening”, which is code for “we have no idea why this is happening, or whether there even is a reason”.)

Click on chart of "first month Brent Crude Oil futures" to enlarge, courtesy of Reuters.

Wednesday, May 04, 2011

Victory Of Monetarism At Citi

Tobias Levkovich, the US equity strategist at Citigroup, posted the "chart of the month" yesterday, and the monetarism obviously leads the investment idea there:

Credit conditions remain critical for business investment and economic activity. The latest senior loan officers survey released by the Federal Reserve Board shows further easing in loan standards during 2Q11 (including those for small business and consumers) which has been a powerful nine-month lead indicator for investments in human, physical and working capital. As credit conditions improve, it is highly likely that business trends and GDP should remain constructive for the balance of 2011, reducing the probability of economic weakness developing. However, actual commercial & industrial loan activity lags the survey by 18 months and investors need to understand the differences in timing.

And the market concerns should be misguided:

Concerns about QE2 ending, higher energy prices and some moderation in ISM new orders miss the durability point. While the investment community may get distracted by the end of the Fed’s $600 billion in bond purchases this June, not to mention plausible softening in ISM new order figures from current elevated levels, the costs of corporate capital is far more crucial for determining capital spending programs as the return of investment capital is weighted against its cost. Indeed, worries with respect to higher gasoline prices undermining consumption should be offset by more jobs as a result of the eased lending standards. Thus, as the credit environment progresses more favorably, so should the decision making to generate returns.

Click on chart to enlarge, courtesy of Citigroup Global Markets.

Bears should be disappointed? Well, if not Loan Demand, Not Credit, Is The Problem ... and some price issues ...

Credit conditions remain critical for business investment and economic activity. The latest senior loan officers survey released by the Federal Reserve Board shows further easing in loan standards during 2Q11 (including those for small business and consumers) which has been a powerful nine-month lead indicator for investments in human, physical and working capital. As credit conditions improve, it is highly likely that business trends and GDP should remain constructive for the balance of 2011, reducing the probability of economic weakness developing. However, actual commercial & industrial loan activity lags the survey by 18 months and investors need to understand the differences in timing.

And the market concerns should be misguided:

Concerns about QE2 ending, higher energy prices and some moderation in ISM new orders miss the durability point. While the investment community may get distracted by the end of the Fed’s $600 billion in bond purchases this June, not to mention plausible softening in ISM new order figures from current elevated levels, the costs of corporate capital is far more crucial for determining capital spending programs as the return of investment capital is weighted against its cost. Indeed, worries with respect to higher gasoline prices undermining consumption should be offset by more jobs as a result of the eased lending standards. Thus, as the credit environment progresses more favorably, so should the decision making to generate returns.

Click on chart to enlarge, courtesy of Citigroup Global Markets.

Bears should be disappointed? Well, if not Loan Demand, Not Credit, Is The Problem ... and some price issues ...

Tuesday, May 03, 2011

Nomura: US Factory Orders Rose Because Of Higher Gasoline Prices

While media focuses on headlines of factory orders, the real picture may be a bit different to Keynesian dream that either neglects or intentionally sees compression of corporate margins.

However, the economists at Nomura explain today:

US factory orders rose 3.0% m-o-m in March exceeding market expectations of a 2.0% increase. Although the solid growth in orders partly reflected healthy growth in the manufacturing sector, price effects of higher input costs to some extent drove up the US dollar value of orders for US manufactured goods. Orders for nondurable goods jumped 3.1% in the month, part of which was led by a 7.8% m-o-m increase in orders for petroleum and coal products. The solid gain in overall orders should be viewed with caution because of price effects, as orders for goods excluding petroleum and coal products rose by only 1.7% m-o-m compared with the 3.0% increase in orders for overall products.

Well, probably Fed will discover someday the difference between nominal and real growth, which one is to drive the employment ...

However, the economists at Nomura explain today:

US factory orders rose 3.0% m-o-m in March exceeding market expectations of a 2.0% increase. Although the solid growth in orders partly reflected healthy growth in the manufacturing sector, price effects of higher input costs to some extent drove up the US dollar value of orders for US manufactured goods. Orders for nondurable goods jumped 3.1% in the month, part of which was led by a 7.8% m-o-m increase in orders for petroleum and coal products. The solid gain in overall orders should be viewed with caution because of price effects, as orders for goods excluding petroleum and coal products rose by only 1.7% m-o-m compared with the 3.0% increase in orders for overall products.

Well, probably Fed will discover someday the difference between nominal and real growth, which one is to drive the employment ...

Monday, May 02, 2011

US Nominal Vs Real Spending

I am not going to make long speech or writing about the sustainability of US spending, but it is the driving force of "growth" again. Just one question to Mr. Bernanke who is about to embrace new real-time tests of Philips Curve. Is nominal or real growth more likely to lead to employment gains?

Click on chart to enlarge, courtesy of BNP Paribas.

Click on chart to enlarge, courtesy of BNP Paribas.

Friday, April 29, 2011

Beijing To Battle Stubbornly High Inflation?

I do not do this often, but this took me to the edge today. Media is failing every day in trying to explain the markets, however, today the headlines of Yuan Breaks Past 6.50/Dollar, Further Gains Seen and alike bring me laughing down on the floor, in particular assertions like this:

Beijing will continue to let the currency strengthen quickly to battle stubbornly high inflation.

Focus on US dollar is so misleading, if one considers to look at, e.g., NEER. Click on chart to enlarge, courtesy of Standard Chartered.

The success should be obvious?

Beijing will continue to let the currency strengthen quickly to battle stubbornly high inflation.

Focus on US dollar is so misleading, if one considers to look at, e.g., NEER. Click on chart to enlarge, courtesy of Standard Chartered.

The success should be obvious?

Thursday, April 28, 2011

Surprised By Bullish Action In Bonds?

This "Chart of the week" from macro team at Nomura explains the bullish action (lower yields for longer term bonds) in US.

Click on charts to enlarge, courtesy of Nomura.

If that is not a sufficient evidence, one may look at the latest updates on global cooling by Simon Ward.

Well, Citigroup Economic Surprise Index provides an alternative view too.

Click on charts to enlarge, courtesy of Nomura.

If that is not a sufficient evidence, one may look at the latest updates on global cooling by Simon Ward.

Well, Citigroup Economic Surprise Index provides an alternative view too.

MSCI USA Standard Core Index Year-To-Date In EUR

Just like back in November of last year, took a look at bullish US stocks in terms of EUR year-to-date via MSCI.

Click on chart to enlarge, courtesy of MSCI.

Click on chart to enlarge, courtesy of MSCI.

Wednesday, April 27, 2011

Ben Decided To Run Real-Time Tests On Philips Curve

Obvious hype was the Ben's Press event today, while FOMC statement was taken neutral, for example, by Swedish SEB. Interestingly, Ben appears to be running a real-time test of Philips Curve, while Fed's staff raises inflation expectations and downgrades the real growth outlook ...

Tuesday, April 26, 2011

Reading Wake-Up Call By Jeremy Grantham

The fact is that no compound growth is sustainable. If we maintain our desperate focus on growth, we will run out of everything and crash. We must substitute qualitative growth for quantitative growth.

Finding statements alike interesting? Go and read the entire message here.

Finding statements alike interesting? Go and read the entire message here.

Thursday, April 21, 2011

Fed's "Masochism"? Well, Sadism

These charts from economists at BNP Paribas tell the bitter story. Click on charts to enlarge, courtesy of BNP Paribas.

Enjoy the long Easter holiday!

Enjoy the long Easter holiday!

Wednesday, April 20, 2011

Korean Beauty

Presented without comment, available live at StockCharts.com.

Click on chart to enlarge.

Cannot resist?

Click on chart to enlarge.

Cannot resist?

Tuesday, April 19, 2011

Which Asset Classes Will Outperform In 2011?

While I have no clue which asset classes will outperform this year, but the latest results from Citi institutional investor survey are indeed intriguing, as Tobias Levkovich writes:

Our most recent fund managers’ poll, conducted this past week, and encompassing nearly 100 responses, shows meaningful changes from early January’s results. In particular, enthusiasm for the dollar has weakened significantly, as average cash holdings dipped and the desire to buy stocks has edged lower. Plus, more than 50% see a bigger chance of the markets sliding 20% than gaining 20%, a sharp reversal from the January 2011 view, when nearly 70% saw a large gain as being more likely.

While more than 50% see a bigger chance of markets falling 20%:

Overall, investors still like US stocks compared with other asset classes (see Figure), but commodities have gained some traction of late, as dollar weakness fears probably are contributing to the mix. Indeed, most investors now think that the dollar will weaken further as opposed to what proved to be inaccurate optimism for greenback strength in January. This may reflect the budget fears but also the expectation that the Fed will not be lifting short-term rates until 1H12.

Click on chart to enlarge, courtesy of Citigroup Global Markets.

Indeed, why not falling in love with US equities? Well, I still prefer to be contrarian ...

Our most recent fund managers’ poll, conducted this past week, and encompassing nearly 100 responses, shows meaningful changes from early January’s results. In particular, enthusiasm for the dollar has weakened significantly, as average cash holdings dipped and the desire to buy stocks has edged lower. Plus, more than 50% see a bigger chance of the markets sliding 20% than gaining 20%, a sharp reversal from the January 2011 view, when nearly 70% saw a large gain as being more likely.

While more than 50% see a bigger chance of markets falling 20%: