Here's the summary:

• At the beginning of last year we likened commodities to the Sirens in Greek mythology. At that time we believed commodities were singing an alluring melody to global investors given the extreme financial market dislocation that was enveloping more traditional asset classes.

• At the start of 2009, we believe the punishment of Sisyphus is a more relevant analogy for commodity markets. According to Greek mythology, Sisyphus was punished for all eternity to roll a heavy stone up a hill only to watch it roll down again before he reached the top.

• Like Sisyphus, we believe the ability of world growth to push commodity prices, and

specifically energy and industrial metal prices, higher in 2009 will be fraught with difficulties.

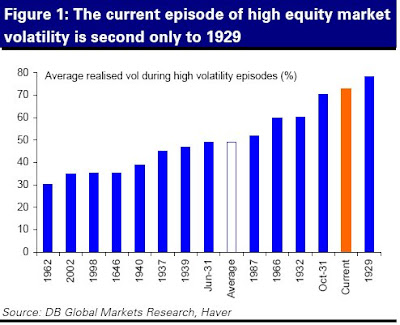

• In fact the current episode of volatility, as measured by the VIX index, is second only to 1929. We believe the longer asset market volatility takes to subside, the larger the downside risks to global growth and commodity prices will be.

• What may interrupt this negative price outlook is not only new money being put to work in the complex, but, also the aggressive monetary and fiscal action being adopted by central banks and governments around the world. For example, in the next few weeks both the US and Europe will announce new fiscal stimulus measures to cushion the economic downturn.

• However, we remain concerned that a selfsustaining recovery in the major industrialised economies will not start to take hold until 2010. Indeed in Asia we expect the Chinese economy to slip back into recession at the start of next year and

this is one of the reasons why our 2010 USD55/bbl crude oil price forecast lies significantly below the USD75.4/bbl consensus forecast.

• We would therefore view any rally in energy and industrial metal prices in the first half of this year as selling opportunities. We believe crude oil prices will only start to stabilise in the fourth quarter of this year, twelve months after OPEC started to cut production to defend oil prices. We believe a weak oil price will also constrain price advances in parts of the agricultural sector.

• We view gold as an attractive investment opportunity in the first half of this year as the US dollar will be exposed from a capital flow perspective.

By the end of last year many markets had priced in, or had been dislocated to levels where prices implied a fundamental economic outcome approaching the Great Depression. We believe a necessary condition for commodity prices to recover requires a significant reduction in risk aversion levels. According to our FX

Research team, the current high level of volatility has only been surpassed in 1929, Figure 1.

In terms of duration, if the current high level of volatility continues until March 2009 then it would be on a par with events in 1932. Given our view that the world economy will escape deflation we believe financial markets will begin to position for reflation during the course of 2009. Indeed one could argue equity markets may already have hit rock bottom and are attempting to form a base around current levels. However, in our view the rapid reduction in the Fed funds rate over the past year only signals a moderation in asset market volatility beginning at the very end of 2009.

We expect that once reflation takes hold the significant moves in commodity prices, forward curves and volatility seen in 2008 will start to reverse. However, we are wary that false rallies are likely to be a feature of global commodity markets in the first half of this year as markets search for a self-sustaining recovery and a reduction in asset market volatility.

Well, consider as a PROBABILITY...

No comments:

Post a Comment